Goldcorp TSX:G, NYSE:GG, the lowest cost per ounce producer of gold among tier 1 companies. In 2010 it produced 23 million ounces of silver giving it the distinction of leading producer of silver among gold companies that year, though production was still only about half of BHP Billiton's (46.6 million ounces) it was high enough to rank 4th among all companies, ranking just behind Pan American Silver (24.3 million ounces). What's more, 77% of Goldcorp's 2P silver reserves (1.0 of 1.3 billion ounces) are at Penasquito, Mexico, a property that only recently reached commercial production. stock +150% last decade.

First Majestic Silver TSX:FR - has significant resources that don't show up as reserves because of their status, has one of the lowest cash costs industry-wide, nearly doubled silver production in 2010 and mints its own bullion bars and rounds (unlike many of its competitors like Pan American Silver which produce and market bullion through other companies (Northwest Territorial Mint for example).

Silver Standard Resources TSX:SSO, NASDAQ:SSRI - is another to keep watch of. The company is already a major producer and that's with only 1 of its 4 properties producing. Cash costs are still high because many new mines have high initial production, initial construction and other development costs.

Hedge funds & speculators are short, Banks are long (for the first time in a long time) and physical metal is running out in vaults worldwide - the price can only be headed up from here.

Summer 2013 represents a historic buying opportunity.

key notes: physical bullion has advantages over companies which have been guilty of issuing too much equity. Key hedge funds such as John Paulson's only buy gold.

The Chinese Factor : Averaged over the first six months of 2013 China imported 4t of gold per day 1400t annualized and exporting nothing.

Negative factors: 2013 India festival diwali saw gold demand drop 33% versus previous year. New tax on gold bullion imports to India of 10%, jewelry up to 15%.

The gold to silver ratio remains high (67.3 May 2014 vs 61.96 May 2013; 55 in January 2012 (silver 30, gold 1620), up from 35 on May 3, 2011 (Silver 44, Gold 1540)).

When investing remember that Silver and gold bars are classed "Currency and Monetary Instruments" meaning that without proper documentation, they will not be confiscated at border crossings. Jewelry is not classified the same way meaning you can cross borders with thousands of dollars worth of jewelry. Company stock performance lags the price of gold. Companies have been criticized for issuing too much equity.

Timmins Gold TSX:TMM gold production 3 months ended June 2013, 28th ounces up 20%. owns 100% of gold mine in Sonora, Mexico. Sales of silver up 12% to 16,124 ounces.

What is China planning to do with all its gold ? Despite producing over 13% of the world's gold the country is a net importer.

Hecla Mining Company NYSE:HL - August 19-22 gold was up about 5.5% but silver was up more than 9%. Hecla Mining, like many other silver miners, has suffered from volatile prices ever since silver recorded a high of about $49/oz on April 29, 2011 Hecla Mining has high growth potential relative to other silver miners because its fall over the last year has been more pronounced. Hecla has low net cash costs realized (-$1/oz in 2010). In other words Hecla Mining is a high Beta stock (stock performance has been more volatile but when conditions are right (commodity prices rise) there's the potential for higher returns. Other companies with a high beta (using current prices versus price targets): Tech Resources and Stillwater Mining. More specifically, Beta represents the magnitude of the ratio between moves in a stock's price and the overall market in general (usually between -2 and +2) with the benchmark being either a particular index (S&P), a more international index or one combining an index with a commodity price.

When high inflation follows the beginning of a recession, they combine

to produce long term stagflation making true hedges against inflation

harder to come by due to the compound effect and its impact on currency

markets (high inflation in the world's developing economies is one of the key factors propping up long term gold prices).

Currently, a number of the world's major economies find themselves in

that situation and that's threatening to destabilize the world economy;

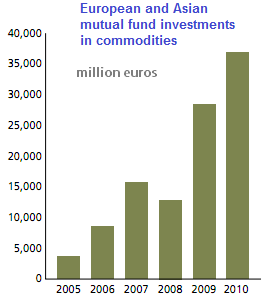

Because of the changing face of the world's economy (relatively new

sectors like the Quaternary playing a larger, central role), the way

people do business and most importantly the much more deeply rooted

connections nations have with each other, history can't be used as a

guide for people looking for answers. Though risky,

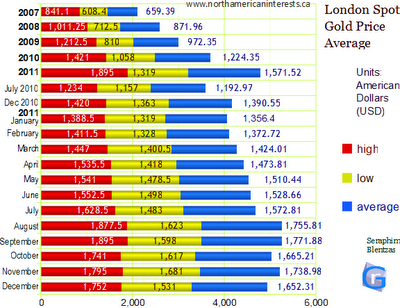

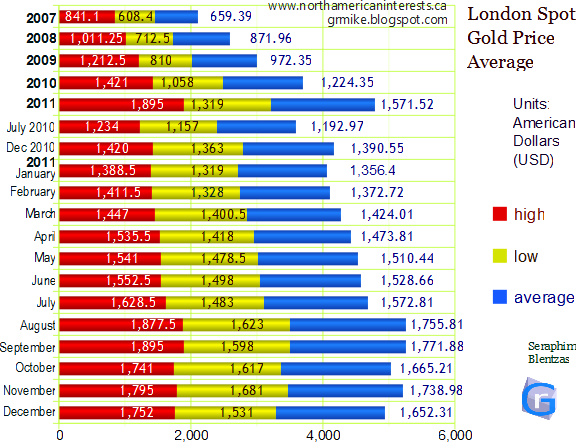

during the latter part of the last decade bonds have had the second highest rate of return second only to gold

(price of gold up 43.93% or $527.70 (August 9, 2010 - August 9, 2011).

The market volatility, inflation and overall economic tightening are

errily reminiscent of the 2008 recession, the big problem now though is

that the US government has used up most of its arsenal (quantitative

easing, stimulus) leaving it highly vulnerable. New Big Factor affecting comex silver: In the COMEX futures markets multiple margin hikes occurred in

2011 which reduced long contracts driving down the price. That formed a stronger foundation for other price

advances.

The commodities market is entering a period of consolidation and deflation attributable to the new US debt ceiling cap for 2013, dollar rally and gold and silver's post 2008 rally. The gold to silver ratio is nearing 60 which represents a doubling since April (historically the higher ratio corresponds to lower commodity prices but I consider today's events to be unique and a correction is likely to happen when the debt problem is left to correct itself, without any stimulus from the US Reserve, IMF. Central banks continue to buy (Russia, Colombia, Russia, Mexico bought 26 tonnes in October 2011 at the same time gold etf's increased their reserves up to a record high of 69.978 million ounces). Poor debt sale showings in Italy, Germany and Spain mean debt may literally be insurmountable, that would lead to greater central bank buying.

What is certain is that when money devalues, commodities like gold, silver and oil don't.

Gold and silver have intrinsic value that isn't easily replaced (few

substitutes); their properties are valued both economically

(industrially) & aesthetically and according to history, are

reliable stores of money (gold was used as legal tender even before the

first coins, silver use in rfid scanners and tracking devices is one of

the sources of demand growth). Also, overall base metal production has

been falling, at the same time central banks which used to be net

suppliers have become net buyers.

Western countries such as the United States, have

become increasingly

reliant on quantitative easing to stimulate the economy.

Quantitative easing has as a direct consequence the devaluation of curency which contributes more to inflationary pressures (if the effects aren't felt immediately they ultimately do later on when the economy heats up). U.S. deflation is part of the reason quantitative easing is such an attractive option (increasing the money supply lowers interest rates which raises prices through foreign currency markets) however the root of the deflation America is attempting to correct isn't even a result of high interest rates (more recently) or a money supply problem meaning the government may just be creating a new problem. (thetombstonenews: 'Quantitavie Easing') Some interesting facts about gold: 3/4 of all the gold ever extracted from the earth was mined after 1910. South Africa was the largest producer in most years since that time. Switzerland was the last country to tie its currency to the price of gold (1999). Until May 2009, all the gold ever extracted amounted to 5,835,876,025.6 ounces or about 85% of an ounce per person (165,446 tonnes). Gold weighs 19.3 times as much as water, is even more rare than diamonds, never oxidizes (maintains its shine), and in its more natural form is one of the softest metals.

When deciding on Gold ETF's/Gold Stocks consider this : contracts like the precious metals loan device (government/central banks) and those made by NYMEX/COMEX and London Precious Metals Clearing Limited (involves 6 big banks including JP Morgan) are short by a significant margin when it comes to the amount of gold and silver they need to cover those positions. Also, JP Morgan is now owner of a vault license, throwing more uncertainty into the equation as JP Morgan has used unallocated gold and silver to cover contracts. Though riskier, gold stocks also pay dividends annually or quarterly, in 2011 Q2 Barick Gold's African subsidiary doubled its dividend up to 3.2c/share for the quarter alone.If, as many suggest, the People's Republic of China lets the RMB increase in value relative to the USD, that will weaken demand for gold in the short term as investors see the new exchange rate as a sign of economic stability but in the long run, the stronger RMB will increase Chinese demand for Gold due to its greater purchasing power. Also, a stronger RMB will raise Chinese import demand, indirectly increasing Gold demand from abroad too.

Also consider that the rise and fall of stocks isn't entirely determined by commodity prices. Other factors such as the enterprise value (see Yamana Gold blog entry), free cash flow (cash flow minus capital expenditure) and most importantly total cash cost per ounce (the main reason Canadian companies like Goldcorp and Eldorado Gold make it to the top in terms of market value while others like AngloGold and Gold Fields which produce and own a lot more than their counterparts, aren't ranked significantly higher) tend to have more of an effect on prices. There are many examples of gold companies that have a market value close to what it was 2 years ago despite commodity prices being many times higher; there was less than a 30% difference in market value for Agnico-Eagle Mines, Yamana Gold, Gold Fields, Kinross Gold (not considering the Red Back acquisition its capitalization was actually steady) while others like First Majestic Silver realized the change in price (was worth US $215 million in 2008 ten times less than in 2010 despite only producing 1.89 times less silver). Also, consider this: For most of 2008 when gold prices started their overall upward trend, it was the large cap companies that outperformed the small cap; the opposite was true in the summer of 2011 when gold prices broke through new levels, the change in behavior might simply be the result of a much higher support level for gold prices making high production costs less of an issue for startup companies (many more juniors entered the market in 2011 than in 2008). Physical gold and physical silver remains the safest investment option as there is less risk (no concerns regarding delivery of the asset) and the investor gets to realize 90-100% of the rise in gold and silver prices (on demand price paid by bullion dealers at coins stores for the metal). What the physical gold investor loses out on are dividends paid out by gold mining stocks. A major factor affecting spot prices, which is unrelated to stocks are margin calls. For example in early August of 2011 when there was a lot of economic uncertainty gold and silver spot prices declined at the same time major stock indices fell by their largest margins since the 2008 recession. The commodities selloff was sparked by a margin call (temporary selloff due to traders being required to meet call options). Recently, South Korea, Thailand and even debt-laden Greece added more gold to their reserves. (Gold Cartel losing, price to top $3000) On August 8, 2011 when stocks performed poorly, gold spiked again (gold is the first thing central banks/banks/investors hoard when they want a stable investment medium, also when banks realize they might have to fulfill their significant short positions) but don't be concerned about the more gradual silver rise (historically, silver has lagged gold (time) when increases occur; the reason is that banks and large investors tend to wait until gold gets too expensive before buying the white metal); also when gold gets too expensive jewelers, industrials turn to alternatives and silver is one of them. Also consider the gold/silver ratio which is 44 (August 8, 2011), much higher than the historic ratio of under 20. Silver has, in just 5 years gone from $14/oz to a support level of between $34 and $40 per ounce.