Financials: Royal Gold as traded on the Nasdaq with the ticker RGLD Stock is up 9% between Oct 10 and Jan 10 2012, up 17.8% during the six month period ended Jan 10, up 13.17% six months ended Feb 2nd, down 9% in the month of December but up 13.64% in the month of January. The company holds many key royalty claims; 2.0% NSR claim on Canada's biggest gold/silver/copper/molybdenum project (KSM) purchased in 2011 for $160m; 2.0% claim on Goldcorp's mega silver mine Penasquito; claim on Barrick Gold's Pascua Lama mine in Chile. In 2011 (fiscal year ends in June) revenue is up 58.5% to US$ 216m which is great considering total operating expense was virtually unchanged at $97m pushing gross profit up 190.0%. Net income was $71.39m (up 232.2%) though dividends were only up 23.5% to 42 cents a share. In the 1st half of fiscal 2012 it began receiving revenue stream from Holt and Malartic.

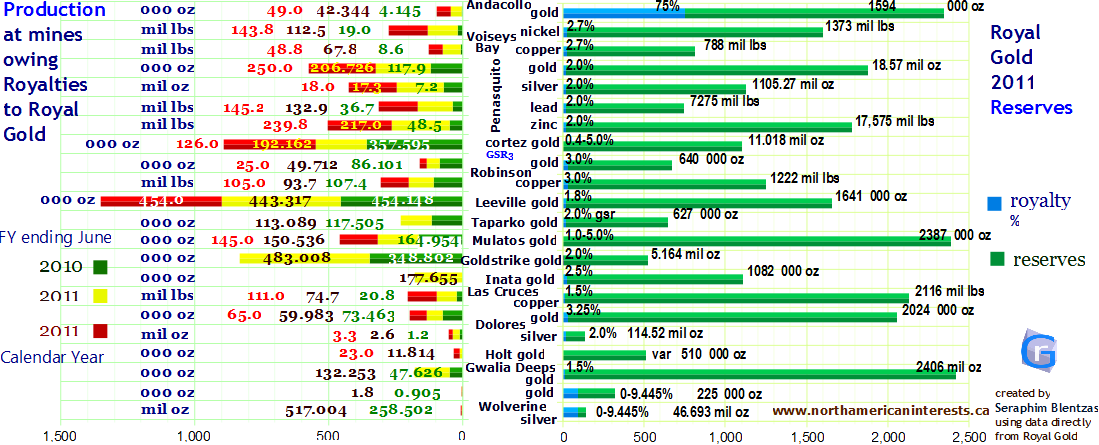

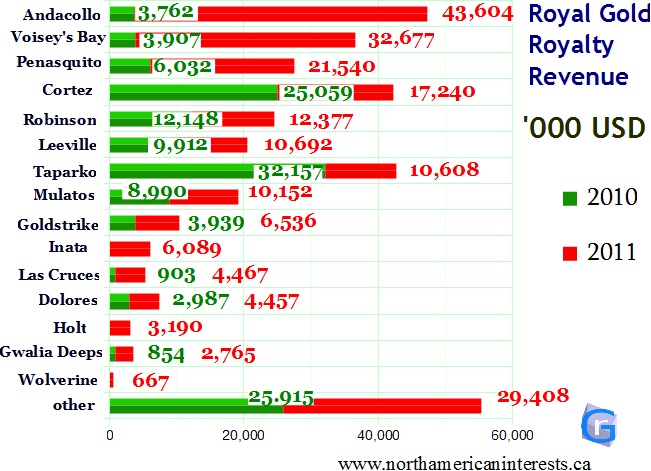

Second quarter 2012 fiscal year Update (ends December 2011): profit/earnings record for a quarter at $23.4M up 28% qoq or 42 cents a share on royalty revenues of $68.4M, up 22% qoq. For the 2012 half, net income was $45.9M (up 52.5%) or 83 cents a share (up from 55c) on revenue of $133.3M (up 31.07%). adj EBITDA was 90% of revenue in the second quarter or $62.1M up from $48.9M (87%) in 2Q2010. For the September-December 2011 period (2Q of the company's 2012 fiscal year) the price of gold increased 23% from $1367 to $1688 an ounce. The company recently paid $170 million on its debt (credit facility) expanding available credit under the facility to $225 million. Revenue increases were driven largely by higher output at Andacollo (gold) & Voisey's Bay (nickel, copper). The 23% boost in gold price played a significant role in the company's cash flow of $29.M in the quarter up from $27.1M, per share up to 53 cents from 49 cents. $16.18 million of the comany's $68.84 million revenue (23.50% up from 20.12%) came from Andacollo, the gold mine that Royal Gold has a 75% interest in. The only other mine that contributed over 10% of royalty revenue is Voisey's Bay where the 2.7% net smelter return royalty) translated into $12.04M in royalty revenue during the second quarter (17.49% of total) up from $8.06M during 2q2011). info on 2q at Royal Gold's 2Q release.

In the second quarter, revenue from Robinson and Cortez fell to $4.61m from $11.1m HOWEVER the other seven leading sources of revenue showed increases including new mines Malartic (prod 54,141 oz gold, rev $1.53m, royalty 1.5%) and Holt (prod 11,461 oz gold, rev $4.23m, royalty arrangement: 0.00013X gold price). Nickel-copper Voisey's Bay (2.7% nsr) is the only major operation that doesn't produce gold. Of the 9 major mines, 6 produce only gold, only Penasquito produces zinc and lead, and all of them are operated by different companies. Also of interest: Royal Gold recently upped its interest in Mt. Milligan gold output to 40% on December 15, 2011 (begins operating 4q2013, 31% complete). The total interest cost it $581.5M only $252.6M of which has already been paid.

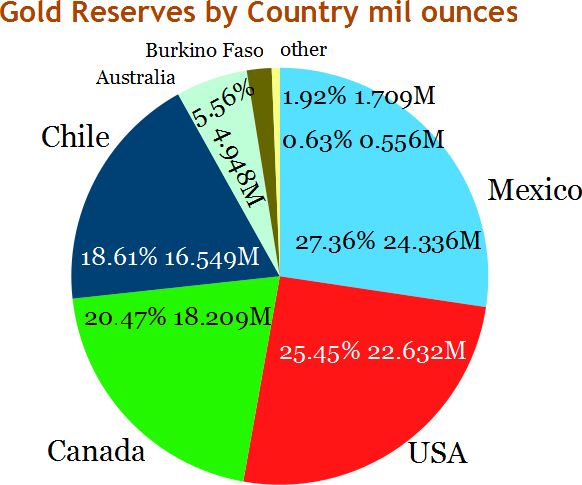

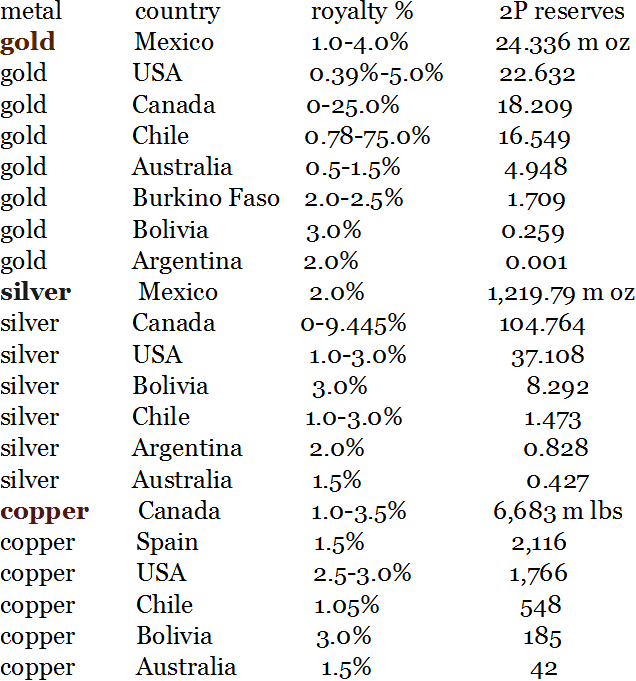

2010 was a big year for Royal Gold, a company which ranks among the world's biggest and most diversified royalty companies. During the year, it took over Canada's International Royalty Company (IRC) for about $700 million. That gave it interest in Chile's Pascua Lama and Newfoundland's Voisey's Bay (home to virtually all of its 1.4 billion pounds of nickel and 7% of its 11.34 billion pounds of copper reserves at mines it has a royalty to). In 2010 revenue shifted away from the USA (over half used to come from the USA, now it's over 70% from abroad).

Royal Gold's four largest sources of revenue contributed 56% of it in the second quarter of 2012). Total gold production by them was

92,358 ounces up from 65,862 ounces, 27.4 million pounds of

nickel (all from Voisey's Bay) as well as Penasquito's output of

5.0m oz silver, 40.2m pounds lead, 78.4m pounds zinc.

Quarter on

quarter increases at Penasquito were mostly from zinc which was up

35.0%, silver was down 100,000 ounces but gold was up 23.8% or 13,052

ounces. Andacollo produced 13,070 ounces of gold up from 11,087 oz.

In 2011 silver contributed 6% to revenue (up from 3% the two previous years), copper steady at 10%, nickel up significantly to 15% from 4% in 2010, 1% in 2009. Other minerals like zinc and potash made up 5% of revenue up from 3% and 1% in 2010 and 2009 respectively.

According to Goldcorp/operator of Penasquito, gold production will be in the range of 425,000 oz and silver 26M oz in 2012 (calendar year). Malartic will produce between 610,000 and 670,000 ounces of gold in 2012. Barrick Gold's Pascua-Lama mine will begin producing mid 2013 at 800,000 to 850,000 ounces a year for the first five years.

Thompson Creek's Mt. Milligan (31% complete end of 2011) will begin producing 4th quarter 2013. Lac Cruces (produces copper cathode) will operate a 90% of design capacity in 2012, total production estimated to increase by 55% versus 2011 (calendar year).

Other notes: nearly all of penasquito's 2.0% silver net smelter return (nsr) royalty covers sulfide ore.

2011 calendar year are estimates made mid year by the different companies, the ones that didn't provide estimates (Voyseys Bay, Wolverine, Penasquito Ag, Pb, Zn) the data is a projection of what the company did produce Jan-Jun 2011).

2nd half of 2011 calendar year will also include new production from Osisko Mining Malartic property in Quebec but that won't show up on the company's notices until mid 2012.

In October 2010 Taparko: TB-GSR1 and TB-GSR2 were terminated, and the Company's perpetual 2.0% GSR royalty (TB-GSR3) became effective. The TB-GSR3 royalty covers all gold produced from the Taparko mine.