Turquoise Hill Resources also known as Ivanhoe Mines Ltd. TSX:IVN NYSE:IVN STU:IHM is a Vancouver based multinational engaged in mineral exploration, development and production. Main operations are in Mongolia however the company also owns minor exploration and development projects in Australia, the Philippines, China, Indonesia and the United States (Arizona). Through a 50% stake in Altynalmas Gold it owns half of the 3.3 million ounce Kyzyl gold project in northeastern Kazahkstan (verified by Scott Wilson Group).[1]. Among major properties only ovoot tolgoi has begun producing albeit in a small capacity (2.5 million tons of copper in 2010 compared to about 1 million tons on average each year prior to that since commencing operations). Oyuu tolgoi and the kyzyl gold project are on track to begin large scale production in 2013 (half) with pre production begining as early as 2011. According to project manager Flur Corporation the Oyu Tolgoi project is going ahead as planned without any significant delays. During the last quarter of 2010 Flur booked 1 billion dollars in backlog for the project after reaching a final agreement with Ivanhoe to continue full scale work.[2] Its subsidiaries Ivanhoe Australia (ASX:IVA) and SouthGobi Resources Ltd. (HKG:1878, CVE:SGQ) are 62% and 57% owned, respectively. The Oyu Tolgoi mine (which Rio Tinto calls the biggest copper resource in the world) is expected to produce at an annual rate of 1.2 billion pounds of copper and 650,000 ounces of gold for the 1st 10 years (700,000 to 800,000 for the first 2 of those years) on a 100% basis (Ivanhoe's share is 66%) reaching full production by 2017/2018. When fully operational the mine will account for 30% of Mongolia's gross domestic product.[2] Oyu Tolgoi is the size of Manhattan with a mine life of potentially 50 years.[3] Latest estimates of Oyu Tolgoi's reserves are at 81.3 billion pounds of copper and over 46.4 million ounces of gold. Production at Oyu Tolgoi won't begin until 2013[4][5]

It also owns 14% of copper, gold and molybdenum exploration company Entree gold Inc. It hasn't had significant interests in silver production since 2002 when it was involved in gold-silver mine in South Korea (Oyu Tolgoi contains close to 180 million ounces of inferred silver reserves).[6] Ovoot Tolgoi is divided into two sections the South portion currently known as 'Sunset Field' which was the site of first production in 2008 and the Western portion nicknamed 'Sunrise Field. 62% subsidiary Ivanhoe Australia owns 22.8% of Exco Resources which is its main partner in the Cloncurry, Australia projects (Exco Resources main asset there is copper, Exco also owns Australia's White Dam gold mine and owns some 117,000 tonnes of copper and 116,000 ounces of gold resources outisde of Cloncurry).[7]

The interest it has in Ivanhoe Australia was 81% in the summer of 2010 before Ivanhoe Australia decided to raise funding by issueing new entitlement offers (initially planned on them being as high as $405 million). The move caused Ivanhoe Mines' share of the subsidiary to fall to 62%.[8] Ivanhoe Mines has exposure to the molybdenum and rhenium markets.

As of November 2010 Oyu Tolgoi 10 year annual production is scheduled to be 544,000 tonnes for copper and 650,0000 for gold. The mine still requires $4.6 billion in capital expenditure before 2012 something that Rio Tinto might try to take advantage of in its bid for a takeover; Rio Tinto owns 35% of shares (November 2010) and is currently fighting for an opportunity to raise that to 46.6% and eventually a majority interest but Ivanhoe claims its shareholder rights plan prevents that from happening). Ivanhoe Mines says that there are other forms of financing available, they include Middle Eastern investors (each would own a minor interset) and financial institutions, among them BNP PARIBAS (BNP).[9] Oyu Tolgoi will also produce silver - 3 million ounces annual production average for the first 10 years (though the mine has a 59 year mine life and could see 180 million ounces production overall).[10]

Graph shows changes in cash flow relating to financial activities and cash equivalents in millions of USD

Company Overview

Company Overview

2011 update - Record production set for 2020, new cash flow, Silver production

2011 update - Record production set for 2020, new cash flow, Silver production

In year 7 of operations (2019-2020) Oyu Tolgoi will produce 1.1 million ounces of gold and 1.7 billion pounds (800,000 tons) of copper (commercial production begins in 2013/10 year avg is 650,000 oz of gold, 1.1 billion pounds of copper). Oyu Tolgoi will also produce approximately three million ounces of silver annually in the first ten years (though the mine has a 59 year mine life and could see 180 million ounces in production overall).[10] Revenue was $20.16 million in the first quarter of 2011 (up 44.8% qoq) on account of higher coal sales at South Gobi/Ovoot Tolgoi (2.5 million tons over the 2010 fiscal period); Revenue was $79.78 million in 2010 121.37% higher than the year before (though net income remained in the red (-211.48 million compared to -280.17 million the year before) due to expensive pre production phase being implemented at Oyu Tolgoi.[10]

Oyu Tolgoi project

Oyu Tolgoi project

The mine is expected to produce 1.2 billion pounds of copper and 650,000 ounces of gold annually.[2] Latest estimates of the mines reserves are at 81.3 billion pounds of copper and over 46.4 million ounces of gold.[4][17] The initial capital cost of the project is 4.6 billion dollars.[18] The Mongolian government owns 34% of the project.[19] Mining licenses are held by subsidiary Oyu Tolgoi LLC. Gold production costs are estimated to be low at around $319/oz.

Ivanhoe and its Oyu Tolgoi partners will need to invest at least US$4.6 billion in Oyu Tolgoi between 2011 and the projected 2013 start up date (capex). Phase 1 of development requires US$5.5 billion in funding (capital expenditure).[20]

The project (dubbed the world's largest copper resource by Rio Tinto) will officially become operational in 2013 and produce potentially for a period of 50 years at tremendous rates (for gold anywhere from 650,000 to over 1 million ounces per year which is even more than the largest gold mines owned by Goldcorp, Newcrest, Newmont etc... and copper over 1 billion would rank it near the top).[13]

In year 7 of operations (2019-2020) Oyu Tolgoi is scheduled to produce 1.1 million ounces of gold and 1.7 billion pounds (800,000 tons) of copper (commercial production begins in 2013/10 year avg is 650,000 oz of gold, 1.1 billion pounds of copper). Oyu Tolgoi will also produce silver ~3 million ounces annually for the first 10 years (though the mine has a 59 year mine life and could see total production amount to 180 million ounces).[10]

Subsidiaries

Oyu Tolgoi, Mongolia - Ivanhoe Oyu Tolgoi (BVI) Ltd. (British Virgin Islands, 100%), Ivanhoe Mines Delaware Holdings, LLC (Delaware, 100%), Ivanhoe Mines Aruba Holdings LLC (Aruba, 100%), Oyu Tolgoi LLC (Mongolia, 6.5%), Ivanhoe OT Mines Ltd. (British Columbia Canada, 100%), Turquoise Hill Netherlands Cooperative (Netherlands, 100%), Oyu Tolgoi Netherlands B.V. (Netherlands, 100%), Oyu Tolgoi LLC (Mongolia, 93.5%)

Ovoot Tolgoi, Mongolia - SouthGobi Energy Resources Ltd. (British Columbia Canada, 57.4%), SGQ Coal Investment Pte. Ltd. (Singapore, 100%), Southgobi sands LLC (Mongolia, 100%).

Cloncurry, Australia - Ivanhoe Australia Limited (Australia, 62%, was 81% in 2010), IAL Holdings Singapore Pte. Ltd. (Singapore, 100%), Orian Holding Corp (British Virgin Islands, 100%), Ivanhoe Australia Tennant Creek Pty. Ltd. (Australia, 100%), Ivanhoe Cloncurry Mines Pty. Limited (Austrlia, 100%) Subsidiaries Tennant Creek and Cloncurry Mines are 80% owned by the parent company (Ivanhoe Mines) and 20% owned by Ivanhoe Mines subsidiary Oyu Tolgoi Mines.[25]

62% owned subsidiary Ivanhoe Australia owns 22.8% of Exco Resources (ASX:EXS) which is a key partner in the Cloncurry, Australia projects. The main asset there held by Exco Resources is the copper project; Exco also owns Australia's White Dam gold mine as well as some 117,000 tonnes of copper and 116,000 ounces of gold resources outisde of Cloncurry).[26]

Chalco Scraps Deal For SouthGobi

Chalco Scraps Deal For SouthGobi

On April 2, 2012 Chinese coal mining company Chalco agreed to buy all of Turquiose Hill's coal operations for $889 million. Mongolia didn't agree with the deal and threatened to change the original terms of agreement. Because of these and other complications, in September 2012 Chalco terminated the agreement meaning that SouthGobi remains a subsidiary of Turquoise Hill Resources. Turquoise Hill Resources' focus remains on developing the Oyu Tolgoi project and for that reason it may still be looking to sell other non-core assets including Ovuut Tolgoi.

Balance sheet

Balance sheet

In February 2005 Ivanhoe Mines sold the savage river iron ore project in Australia for $21.5 million plus five annnual payments of between 20 and 30 million dollars. In 2006 subsidiary Monywa sold its interests in the Monywa Copper Project as part of an agreement with Rio Tinto. In the 2nd quarter of 2010 operations and purchasing payments from operations at the savage river and indonesia coal division were discontinued, primarily due to a dispute with a purchaser regarding the last $22.1 million payment.

The company is faced with costs of $4.6 billion (including $1.1 billion at the Hugo North Deposit) at oyu tolgoi just to get the mine to start producing according to the company's 2010 second quarter report. Oyu Tolgoi operations will involve both block cave and open pit mining.

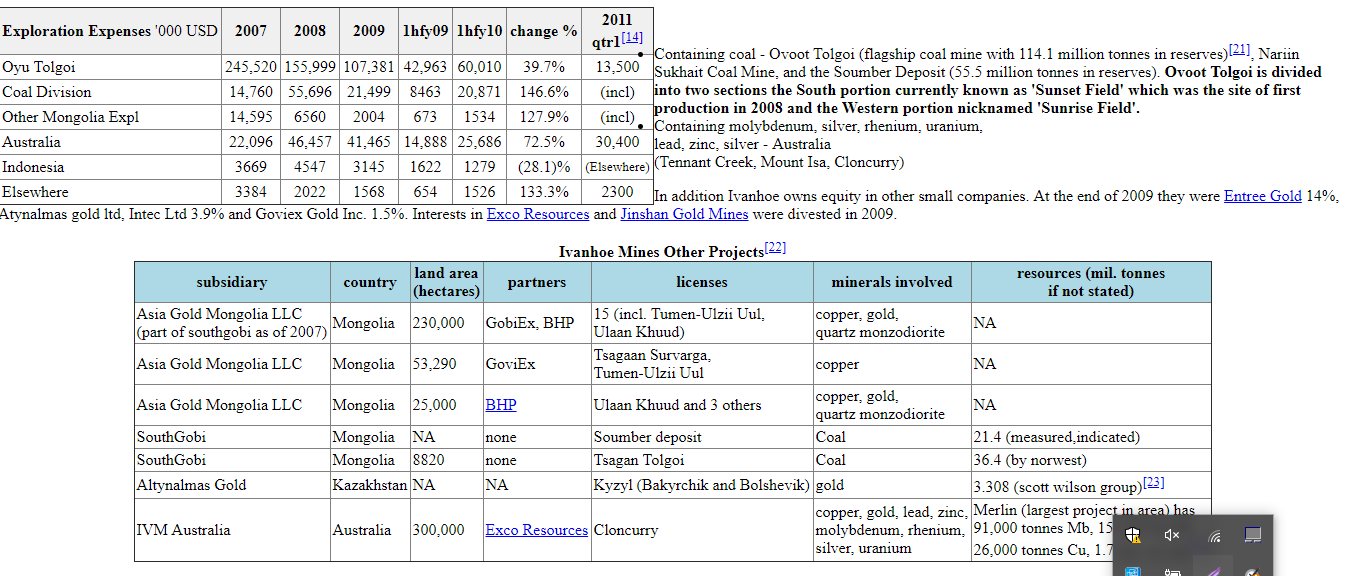

2011 Results - For the first quarter ended March Ivanhoe posted a loss of US$492.5-million US$432.5 million of that attributable to the revaluation of a derivative security (the loss was 79 cents per share 83.7% more in the red than the first quarter of 2010). SouthGobi made 45.3% more sales revenue from coal than in the 2010 first quarter ($20.2 versus $13.9 million) but fell 50% quarter on quarter (last quarter of 2010 was $41.6 million). Cash on hand rose significantly most coming from the rights offering made at the end of 2010, cash ended the quarter at $1.9 billion 2.6 times what it was the previous year ($720 million). Exploration expense : $46.2 million (35.3% less than the year before) $30.4 million (73.1%) came from operations in Australia.[14] Revenue was $20.16 million in the first quarter of 2011 (up 44.8% qoq) on account of higher coal sales at South Gobi/Ovoot Tolgoi (2.5 million tons over the 2010 fiscal period); Revenue was $79.78 million in 2010 121.37% higher than the year before (though net income remained in the red (-211.48 million compared to -280.17 million the year before) due to expensive pre production phase being implemented at Oyu Tolgoi.[10]

Financials - For the third quarter of 2010 revenue was down 62.71% qoq ($6.6 million compared to $17.7 million in the second quarter of 2010) because of lower sales volume at SouthGobi (194,000 tonnes of coal compared to 457,000 tonnes in the third quarter of 2009). The lower sales volumes were the result of low available semi-soft coking coal from one of the Sunset Pits and a limited screening capacity for higher ash, higher sulfur coal. Sales in the short term are expected to be impacted by the fact that more of coal produced from the number 5 seam of the sunset pit is of lower quality than usual, the coal being mined has an increasingly high sulfur content which customers don't want.[29]

Relationship with Rio Tinto

Relationship with Rio Tinto

Rio Tinto's interest in the oyu tolgoi project caused it to gradually buy up more stock of Ivanhoe Mines with whom it is jointly ventured. It is currently Ivanhoe's largest shareholder at 46.5% (prior to that it was 42% and 35% after upping its share in September 2010 from 29.6% after a $350 million credit facility connected to a 2007 loan, matured (About a quarter of those shares were acquired since March 2010).[4]The dispute it has with Rio Tinto centers on Ivanhoe's decision to implement shareholders rates plans which prevents third party shareholders from acquiring more than 20% of the company's stock. The decision aims to prevent companies like Rio Tinto from attemping a hostile takeover.[18] Rio Tinto's has invested $US1.73 billion in Ivanhoe Mines since first acquiring an interest in 2006.[33] Due to an agreement made in 2010 until at least October 18, 2011 Rio Tinto cannot make make a take over bid for Ivanhoe Mines and Rio Tinto is forbidden from owning more than 46.65% of the company.[25] In June 2011 Rio Tinto paid $502 million for 55 million more share of Ivanhoe Mines Ltd. raising its interest in Ivanhoe to 46.5% from 42% and giving it an extra board seat on the company (up to 7/14) though Rio Tinto is restricted from increasing its stake in the company to a majority before 2012. The 46.5% share of the $16 billion company cost Rio Tinto $3.5 billion since 2006.[34]

Ivanhoe Mines Becomes Turquoise Hill Resources

Ivanhoe Mines Becomes Turquoise Hill Resources

On July 31, 2012 Rio Tinto pushed its interest past 50% (51%) after buying $935m more in Ivanohe stock. That gave it more control over company decisions (paid $935 million for more stock). Two days later on August 2, 2012 Ivanhoe was renamed Turquoise Hill Resources; Turqoise Hill is the name of the area where Oyu Tolgoi is located.

Trends & Forces

Trends & Forces

Copper is widely used as it has a range of uses. Its supply has been decreasing however alternative substitues could make its demand vulnerable to price changes. Gold has few substitutes, many uses, and is seen as a hedge against inflationary pressures (which many international economies are vulnerable to due to economic uncertainty). Its decreasing supply to demand ratio provides much positive pressue on demand and price.[35]

Some energy companies estimate that the economic slowdown could impact coal demand into 2009-2010 because of such factors as lower utilizations at processing plants and slower US economic recovery.[36]Continued growth in countries like China has helped to stabilize prices and demand however influences such as energy saving policies could have a big effect over the next couple years.[37]

Silver's uses are rising with the introduction of new technologies. Even though its main source of consumption, photography uses has been waning rising demand for silver consuming technology like RFID tracking devices (tags production expected to double by 2017) could cause silver demand to increase.[38]

World coal reserves have a lifespan twice that of natural gas

World coal reserves have a lifespan twice that of natural gas

Proven coal reserves total 897 billion tonnes (mostly in the USA, Russia, China and India, lead by North America), that's enough to support current production rates for over 119 years. Natural gas on the other hand (the second most important fuel for electricity generation) only has 46 to 63 years worth of proven reserves. That could make coal a better long term answer to high commodity prices and demand (the natural gas to coal price ratio has gone from over 3 to about 1 in just five years (2005-2010).[39][40][41]

Coal production unpopular in the United States but popular in China

Coal production unpopular in the United States but popular in China

Coal is among the cheapest sources of energy production; Per kWh coal costs approximately 4 cents, that compares to 9 cents for natural gas and 23 cents for renewables (including wind power). Because of that there is a growing interest in building power plants in China (one major one built each week) however policies in the United States are shifting the focus over to renewables which are both environmentally friendly and more expensive (as of 2010 the shift was subtle (the United States exported 25% more coal or 100 million tons in 2010 than it did the year before, in 2011 coal exports are expected to continue to be high making up for unstable production out of Australia).