Thesis on The Contributions of Coal Power to Electricity and Price Stability

research by SERAPHIM BLENTZAS

Nine-percent, or 6,600 billion kilowatt-hours, of the electricity produced in the world comes from turbines powered by coal.[1] As the most abundant fossil fuel in the U.S., coal-fired plants accounted for 50% of the electricity consumed domestically and, in order to meet domestic consumption, U.S. miners produced 1.145 billion short tons in 2007.[2] Although considered a nonrenewable resource, coal is the largest source of electrical power because the massive amount of coals reserves make it an affordable source of electricity in comparison to its closest competitors, natural gas and nuclear energy.[3] Because it is so inexpensive, the Steel industry uses a type of coal baked in a furnace, known as coking coal, to manufacture iron into steel. As a result, coal offers a cheap and abundant way to produce electricity and steel.

Electric utilities are the biggest users of coal; 93% of coal consumption is by the electric power sector.[4] As a result, coal consumption is driven by economic output and the demand for power. Like thermal coal, coke consumption is also dependent on economic activity because steel is needed in new construction projects. In 2007, the rising global demand for energy in Asia was the primary source of global coal consumption and U.S. exports of coal.[5] Starting in mid 2008, global industrial and manufacturing output dropped as a result of the global recession beginning in early 2007. As output declined, coal consumption and prices dropped. Many analysts are predicting coal consumption and prices to drop further in 2009 as Asian industrial output declines.[6]

In 2009, growing concern over global climate change and the new Obama administration will provide additional challenges for coal miners. Burning coal produces the greenhouse gas carbon dioxide, making natural gas and nuclear power generation more attractive alternatives, environmentally speaking. In response to global climate change, President Obama has proposed several measures to reduce the U.S.’s production of carbon dioxide including $18 billion dollars in government funded research for renewable energy and a carbon emissions tax.

Contribution to electricity generation worldwide

Background

Although coal is the most abundant fossil fuel produced in the U.S., the combustible, black sedimentary rock takes millions of years to form. [7] The combustible energy in coal comes from the energy stored by swamp plants that were buried under dirt and water over the course of 100 million years. [8]Because it takes millions of years to form coal, it is considered a nonrenewable energy source.

Types of Coal

Coal is classified into four main types:

Lignite(7% of U.S. Coal Production): Coal deposits that contain the lowest energy content because they were not subjected to enough heat and pressure.[9]

Subbituminous (44% of U.S. Coal Production): Contains 35-45% carbon and has a higher heating value than Lignite. [10]

Bituminous (50% of U.S. Coal Production): The coal most commonly used to generate electricity, to make steel, and to make iron because of its abundance in the U.S. and its higher carbon content (46-86%).[11]

Anthracite (<.5% of U.S. Coal Production): Although it has a carbon content ranging from 86-97%, anthracite is rarely found in U.S. coal beds.[12]

Coke: Bituminous coal baked in hot furnaces produces a hard, gray substance that burns at extremely high temperatures. The heat produced from burning coke is hot enough to smelt iron ore into iron, which is used to make steel.[13]

U.S. Coal Reserves

Coal reserves refer to coal still in the ground waiting to be mined.[14] The U.S., which has the world’s largest known coal reserves, has an estimated 263.8 billion short tons of coal reserves.[15] At today’s rate of production and consumption, these reserves would last approximately 225 years. In 2007, the amount of coal mined and sent to the market was 1.145 billion short tons. In 2008, coal production is estimated to be 1.179 billion short tons. In the U.S. approximately 33% of coal production comes from the Appalachian region, 50% comes from the Western coal region, and the rest comes from the Interior coal region. [16] However, the amount of world coal reserves are estimates, and some experts disagree with the official numbers.[17] In particular, David Rutledge, a engineering professor at Caltech, estimates that only about 400 billion tons of coal are economically extractable from the earth.[18] He argues that official estimates, which predict that there are almost 900 billion tons of coal reserves, have inflated actual findings for political reasons.[19]

Coal miners use two methods to extract the rock from the ground: surface and underground mining. In surface mining, which pertains to mining coal less than 200 ft below the surface giant machines remove top-soil and other layers of rock in order to expose the coal deposits.[20] Surface mining accounts for two-thirds of coal production in the U.S. because many of the coal beds are close to the surface. The remaining one-third of coal production in the U.S. involves deep, underground mines to remove coal up to 1000 ft. [21]

International Coal Production and Consumption

Although the U.S. has the largest known coal reserves, China produces almost 220% more coal than the U.S., making it the largest producer of coal in the world.[22] Coal production in the Asia Pacific region has grown 78% from 1997 to 2007, in order to provide electricity and coke to the economies in China, India, and Japan. In terms of consumption, China, the U.S., and India used 1.3 billion, 613 million, and 208 million tons of coal in 2007.[23]

Trends and Forces

U.S. Domestic Regulation places the future of many coal powers in Jeopardy

EPA regulations designed to lower potentially-harmful pollutants and reduce health costs have the potential of forcing the upgrade or closure of many older coal production plants.[24] The EPA estimates that the overall cost to meet the new regulations to be $2.8 billion per year, which presents a problem for individual, older, and smaller plants whose owners may not be able to raise the necessary capital.[25] Most upgrades favor newer and larger plants that can raise the appropriate amount of money.[26] In Pennsylvania, one of the U.S.'s largest coal producing states, about 65% of the state's coal-fired generating capacity would meet the EPA's regulations.[27] While many plants has opted to meet the EPA's regulations, further regulation to prevent pollution and dangerous emissions has the potential of financially burdening plant owners further.[28]

Amidst Domestic Shortages, China has the Potential of Boosting its Imports

Due to harsh winter weather and rainfall, many Chinese power plants are seeking coal imports in order to cope with limited domestic production.[29] Weather has effected both the production and transportation of coal in China, and has left some regions in China with coal levels for 7 days of consumption. While coal imports were limited in the beginning of January 2010, many expect coal imports to rise substantially by mid-February or late-February. As a result, coal exporters in countries like Australia,Colombia, Indonesia, South Africa and U.S. have the potential of benefiting from increasing prices and demand in China.[30] Indonesia, the second largest source of imported coal, is already running its production at full capacity to meet demand in China.[31]

Building and Sustaining Renewable Energy has the potential of Driving Coal Consumption

Although it seems counter-intuitive, the rapid growth in wind power turbine construction has also led to an increase in the construction of coal-fired power plants.[32] These coal-fired plants are intended to act as a power reserve when the wind does not blow and the sun does not shine.[33] China has emphasized the country's transition to renewable, clean energy sources, but coal power plants are being built to power these construction projects. While nuclear power also has the potential of providing a consistent, reliable source of energy, Chinese government officials remain concerned about the safety of nuclear power plants.[34] As China's economy continues to grow, government officials acknowledge their need for a reliant, cheap energy source to power new construction projects and industrial manufacturing. With China's government emphasizing renewable sources of energy, providing clean, but inexpensive power has the potential of being one of the biggest challenges coal power providers face.[35]

Since the Electricity Sector Consumes 93% of the Coal Produced, Economic Activity is a vital Determinant of Coal Consumption

World Coal Consumption by Country Grouping.

The growing need for energy in non-OECD Asian countries(China and India) to power economic developing is the primary growth driver until 2030[36]

In the United States, half of the total electrical power consumed comes from coal-fired plants.[37] While coal has multiple uses, 93% of coal consumption depends on the electric power used by households, industrial and manufacturing plants, and nearly every other building.[38] Additionally, coking coal consumption depends on investment in new construction projects, because coking coal is needed to produce steel and other metals.[39] As a result, coal consumption, production, and prices depend on industrial and commercial growth.[40]

During 2007, coal consumption in the coking sector was lower by 1.1%, while in the electric power sector coal consumption increased by 1.9%.[41] Growth in coal consumption for electricity continued to grow in the first half of 2008. Although electric power coal consumption grew by 1.3% in the first half of 2008, total coal consumption declined 1% in the second half.[42] Low capital investment and less output from industrial and commercial sectors led to the fall in coal consumption in the second half of 2008.[43] The price of coal best illustrates the rise and fall in consumption in 2008. In April 2008, steelmakers paid up to $285 per metric ton of coking coal.[44] More consumption drove contract and spot prices higher as coal mining companies tried to pull as much coal out of the round as they could.[45] Coal consumption is expected increase .3% in 2008, but coal production increased by 2.8%.[46]

When demand dropped, coal miners had huge surpluses of coal already out of the ground.[47] While Electric Utilities and the Steel industry bought less and less coal in the second half of 2008, coal miners began to lower the prices of both thermal and coking coal in order to sell their huge surpluses, which were expensive to store.[48] According to a report by UBS analysts, 2009 coking coal prices will drop to $85 per metric tonne and thermal coal will sell on average for $55 per short ton (.91 metric ton).[49] UBS argued that slowing capital investment, idle high-cost mines, and over supply are the primary forces that will drive 2009 U.S. coal consumption down a predicted 8.2% for coking and .7% for thermal.[50] Altogether, coal production is expected to fall 4% in 2009. [51]

Internationally, coal consumption will depend primarily on the economic conditions in China, India, and Europe. Led by strong economic growth and rising need for cheap energy in China and India, coal consumption is projected to double 2005 consumption levels by 2030.[52] However, the largest increases in consumption are from coal produced and consumed in China, meaning that exports to China have declined dramatically.[53] However, growth in Asia and production problems in China, South Africa, and Australia were the primary reasons U.S. coal exports increased 40% in 2008.[54] Although economic growth in China is expected to slow, its infrastructure-focused $586 billion stimulus package should increase the need for coal as a cheap power source.[55] Economic growth abroad is important not only because coal exports accounted for 5.2% of total U.S. production in 2007 but also because they import steel, which requires coking coal to produce.[56]

A new analysis says the coal sector will have to cut production 50 million tons this year, on top of even steeper cuts earlier in the year, to get supply in line with demand.

According to a report published by the International Energy Agency, global electricity consumption has the potential of falling in 2009 for the first time since 1945.[57] The coal sector has the potential of cutting production 50 million tons in 2009 in order to get supply in line with demand.[58] American coal producers are shipping less coal to utility companies, which has resulted in contract renegotiation and cancellations.[59] Due to the economic recession, steel production is down and utilities are seeing less demand for coal and increasingly relying on cheaper and cleaner forms on energy like natural gas. In the second quarter of 2009, both Massey Energy Company (MEE) and CONSOL Energy (CNX) cut coal production and attempted to reduce their coal inventories.[60] But many electric utilities renegotiated their coal contracts in order to get fewer coal shipments. Higher coal inventories have driven the price of coal down in the first half of 2009.[61]

The IEA predicts that electricity demand is capable of falling 3.5% in 2009 due to the economic recession beginning in 2007.[62] While global electricity increased in 2007 and 2008, declines in the manufacturing and industrial sectors have the potential of bringing about the reduction in electricity demand and global coal consumption.[63] The sharpest falls are expected to occur in Russia and countries in the Organization for Economic Cooperation and Development, which have the potential of falling 10% and 5% respectively.[64]

With Low Coal Prices, Controlling Inventory becomes crucial for Coal Producers

In the U.S., coal prices have remained depressed despite increases in economic activity. Both high inventory levels and low consumption have contributed significantly to coal's low price.[65] Coal producers have made cuts to production but declines in consumption have outpaced those reductions. Coal stockpiles at utilities reached 199.7 million tons in September 2009, an increase of 37% from a year earlier.[66] During the summer of 2009, many Americans reduced their electricity consumption while simaltanesouly increasing the use of electricity derived natural gas. As a result, the summer of 2009 was the first time in 25 years in which coal inventories increased.[67] To combat rising inventories, producers plan on cutting coal production more than they did in 2009 and cut other operational costs. Some producers have shielded themselves from low prices by locking in contracts at higher rates. However, producers have the potential of experiencing significant declines in revenues and profits once those contracts expire.[68] Coal producers are also attempting to export their coal, but transportation and political barriers are preventing many producers from doing so.[69]

Weather Determines Central Air-Conditioning Usage and Conditions of Alternative Power Sources

In 2007, over 14% of the electricity used by household powered central air-conditioning systems and refrigerators in United States[70] With close to 60% of U.S. households equipped with central air conditioning systems, the number of hot days and cold days impacts the amount of electricity used in homes and the amount of coal needed to supply that electricity.[71] In order to account for weather-related electricity usage, the National Oceanic and Atmospheric Administration (NOAA) records the number of heating degree days and cooling degree days, which reflect the need for air conditioning during cooler days and warmer days.[72] Although the data collected by the NOAA can help explain past and current electricity consumption and, therefore, coal consumption, future weather patterns are hard to predict. Additionally, during drought seasons, the amount of hydroelectric electricity generated drops, and coal power electricity is used as an alternative. In 2007, hydroelectric energy accounted for 6% of electrical power generated in the United States.[73] That same year, hydroelectric power dropped 14.6% due to drought. On the other hand, coal consumption grew 1.9% partly because of the fall in electricity produced by hydroelectric plants.[74]

The future Carbon Capture and Storage Systems depend on investments in alternative forms of energy

According to the American Electric Power Co Inc., capture carbon emissions systems have the potential of being ready for use in the U.S. by 2015.[75] As one of the largest American electrical companies in terms of electricity generated, American Electric Power Company (AEP) generates 75% of its power through coal-burning power facilities. Several other power utility companies believe that carbon capture systems are likely to be used nationwide in 2025.[76] The amount of future investment in the development of carbon capture systems depends on the economic viability of alternative sources of energy.[77] Because nuclear, solar, and wind energy are less harmful to the environment, those forms of energy have the potential of receiving more investments from the Obama administration and private investors.[78]

Nuclear Energy and Natural Gas provide "Greener" Alternatives to Coal's Carbon Emissions

Sources of Electrical Power in the U.S. for 2006 and 2007

Sources of Electrical Power in the U.S. for 2006 and 2007[79]

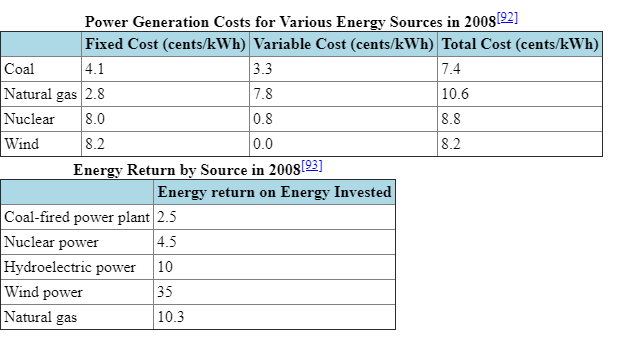

While coal is an abundant and cheap energy resource, the falling prices of other sources of energy make coal less appealing to electric producers. In 2007, coal consumption in the electric power sector increased 1.6% while the amount of electricity generated by natural gas increased by 10.8%.[80] More power plants using natural gas coming online in 2007 accounted for most of the increase in natural gas consumption. [81] While coal accounts for nearly 50% of the energy generated in the U.S., natural gas and nuclear energy account for 20.3% and 20.1% of the electric power sector, respectively.[82] Despite the growing amount of natural gas and nuclear power plants, coal remains the most affordable way to produce electricity. At the end of December 2008, the cost of generating one megawatt hour of electricity for the average natural gas fired plant cost $45.[83]The price for the average coal fired plant was $30. [84]

One of coal's main advantages over other forms of power generation is its lower price.[85] However, low natural gas prices have the potential of leading to increased competition between the two power sources. Although crude oil prices have gained 73% from the beginning of 2009 to February 2010, U.S. natural gas prices have dropped 15% in the same period.[86] On the other hand, coal prices in the U.S. have declined 13% during the same period.[87] Additionally, the discovery of unconventional gas deposits have the potential of leading to increases in U.S. production of natural gas. These two factors are partially responsible for the rise in the share of gas in total power generation in the US. During the fall of 2009, 28% of power generation came from natural gas, up from 20% in the first half of 2009.[88]

According to the International Energy Association (IEA), low borrowing costs and carbon prices at $30/metric ton have the potential of making nuclear power more affordable than its coal-powered or gas-fired competition.[89] The IEA considers cost of capital, carbon prices, local resources, and technology to be among the most important factors for renewable energy's financial viability.[90] As the report outlined, financing costs and the ability of companies to have access to credit are crucial to the construction and maintenance of nuclear power plants and other low-carbon plants. For these reasons, the IEA recommend that government involvement to lower financing costs for renewables is capable of helping the sector significantly.[91]

Power Generation Costs for Various Energy Sources in 2008[92]

Fixed Cost (cents/kWh) Variable Cost (cents/kWh) Total Cost (cents/kWh)

Coal 4.1 3.3 7.4

Natural gas 2.8 7.8 10.6

Nuclear 8.0 0.8 8.8

Wind 8.2 0.0 8.2

Energy Return by Source in 2008[93]

Energy return on Energy Invested

Coal-fired power plant 2.5

Nuclear power 4.5

Hydroelectric power 10

Wind power 35

Natural gas 10.3

Power Plants begin to invest in "Green" Electricity

In response to tighter clean-air policies and relatively high expected natural gas supplies, several power companies are switching from producing coal-derived energy to natural gas-derived energy.[94] According to Shaw Engineering,one-third of U.S. coal power plant have been equipped with pollution controls, which means that two-thirds of U.S. coal power plants still need to be upgraded or shut down in the next 10 years.[95] Not only are these upgrades expensive, but they can run into several problems. For example, Duke Energy's clean coal plant costs have risen to $2.88 billion from $1.98 billion. In addition, big natural gas discoveries in 2008 and 2009 have the potential of keeping natural gas prices relatively low in the future.[96] Because of these two trends, converting plants to natural gas powered, which meet the pollution requirements, has the potential of being an economically viable option for many power generators.[97]

Whether or not natural gas power turns out to be more economically viable than coal, many power generators are in the process of converting to or acquiring natural gas plants.[98] In April 2010, Calpine announced that the purchase of 19 power plants from Pepco Holdings Inc. for $1.65 billion. By 2017, Progress Energy intends to shut down 11 coal-burning plants.[99] At two of its four new sites, the company is building gas-fired plants because the cost is lower to convert than it is to upgrade the pollution controls. However, the future success of gas-fired plants still depends on both climate-related legislative action as well as the supply and price of natural gas.[100]

Obama's DOE Pick Suggests a focus on Greenhouse Gases, but his Stimulus Package has the Potential to Boost Coal Consumption

By appointing Steven Chu to the Department of Energy and John Holdren as the White House Science Advisor, President Obama has made it clear that environmental improvement will be an important part of his agenda.[101] In particular, the Obama administration plans to reduce greenhouse gases, including carbon dioxide.[102] If a carbon emissions tax were enacted, the cost of using a coal fire plant would increase substantially more than plants using natural gas, because burning coal produces twice as much carbon dioxide as burning natural gas.[103]

Although a carbon emission tax would increase the cost of using coal as an electricity source, Obama’s proposed $850 billion domestic spending plan has the potential to increase coal consumption in 2009.[104] Of the planned $850 billion, $18.5 billion will be devoted to renewable energy research and $18.6 billion will be spent on construction projects.[105]

New coal technology is capable of reducing coal's carbon emissions but may not be financially viable until 2030

Clean coal technology refers to new coal-burning processes that emit fewer pollutants into the atmosphere.[106] Because coal is likely to remain the U.S's cheapest and most abundant form of energy, the Bush administration began co-financing research and development of clean coal technology through the The Clean Coal Power Initiative. [107] Government funding for clean coal research and development has the potential to increase during the Obama Presidency. Obama's appointee for Energy Secretary, David Chu, has stated that nuclear energy and clean coal will be among his highest priorities.[108] In March 2009, Oxford Analytica released a report arguing that coal power will need substantial investment in new infrastructure if it is to maintain its dominance in the energy sector.[109] In particular, investments need to be made in Carbon Capture and Storage Systems and power plants that burn coal more efficiently in order to reduce coal's environmental impact.[110] The authors of the article believe that coal power, which currently accounts for 40% of the world's energy, has the potential be replaced, in part, by energy forms that do not produce as much carbon dioxide or use renewable sources.[111]

Additionally, many coal companies have begun to develop and produce coal synfuels, which are liquid fuels made from coal that can power motor vehicles. [112] By using coal as an alternative to gasoline, companies seek to provide a cheaper form of fuel that can reduce greenhouse gas emissions and be produced in the United States.[113] Coal synfuel's biggest customer has been the U.S. armed forces.[114] In particular, the Air Force has stated that it will power its aircraft completely with coal synfuel by 2011.[115]

According to a report by the Global Carbon Capture and Storage Institute, carbon capture and storage systems face significant engineering, environmental and financial challenges, which have the potential of delaying their mass construction until 2030.[116] The Global Carbon Capture and Storage Institute, which was set up by the Federal Government to track CCS projects, performed a series of large scale demonstrations and found that CCS systems come with higher-than-expected costs.[117] According to the report, clean coal power stations require coal prices to reach a minimum of $60 a tonne due to severe financial and engineering barriers.[118] If the G8 intends to reach its goal of 20 CCS projects operational by 2020, then the projects have the potential of requiring significant government incentives that reduce the cost of building and running a clean coal facility. The Federal Government has allotted $2.4 billion to build demonstration projects from 2010 to 2020, but those projects are capable of requiring more financial assistance over the next twenty years.[119]

Production Problems and Lagging Railroad Capacity Threaten Coal Exports

Because coal exports come from so few countries, weather related damages or transportation problems in one country have the potential to lower global coal exports substantially.[120] In 2007 and 2008, flooding in mines and port congestion caused Australian coal companies to postpone several of their coal shipments to Asia.[121] Meanwhile, a lack of available railroad transportation and snow-related damages to mines led to a severe delay in coal deliveries beginning in January 2008 and forced Chinese coal miners to temporarily stop coal export until the beginning of April 2008.[122] While coal exports from Australia and China decreased in 2008, U.S. exports rose 40%, partly in order to replace those coal exports canceled in Australia and China.[123]

In the United States, about half of the total tonnage shipped on trains is coal.[124] So much coal is shipped on railroads that the U.S. Chamber of Commerce expects freight demand will increase by 88% by 2033 due to growing need for low-cost transportation of coal and natural gas.[125] If rail transportation capacity cannot keep up with coal shipments, the U.S. may face many of the same problems as Australian coal companies and Chinese coal companies faced in 2007 and 2008.[126]

Companies That will Benefit from Rising Coal Prices

Coal Miners

Error creating thumbnail

US Coal Prices as of June 2010[127]

As was the case from 2007 to mid-2008, the revenue and profit margins coal miners receive from the sale of coal improve as the price increases. In the first half of 2008, the price of coking coal rose by 200% because of coal shortages due to production problems and higher demand for coal. However, revenues for coal miners are also dependent on coal consumption. When demand dropped during the second half of 2008, coal prices and consumption dropped. Storing the huge supply of coal is expensive, and coal miners are forced to negotiate for prices that are lower and lower.[128] In an effort to prevent further losses due to low coal prices, many coal miners are attempting to lock in contract prices.[129] While most analysts predict coal prices will continue to fall, coal prices are hard to predict.[130] Coal miners locked into contract prices will lose out on potential revenue if coal prices suddenly rise.

Coal Miners

Peabody Energy

Arch Coal (ACI)

Rio Tinto (RTP)

CONSOL Energy (CNX)

Foundation Coal Holdings (FCL)

Massey Energy Company (MEE)

Walter Industries (WLT)

James River Coal Company (JRCC)

Patriot Coal (PCX)

Coal Services

Joy Global (JOYG)

Natural Gas and Nuclear Power Benefit from Rising Coal Prices

While coal is cheaper than both energy produced by nuclear power and natural gas. Natural gas produces half as much carbon dioxide as coal. Alternative forms of energy stand to benefit if there is a carbon emissions tax, which would raise the price of coal. Additionally, Obama’s new administration plans to fund research in alternative energy in order to curtail greenhouse gas emissions.[131]

Natural Gas

El Paso (EP)

Exxon Mobil (XOM)

DCP Midstream Partners, LP (DPM)

Williams Companies (WMB)

Nuclear Power

Entergy (ETR)

Exelon (EXC)

Dominion Resources (D)

Ameren (AEE)

Dynegy (DYN)

PPL (PPL)

Companies that will Benefit from Falling Coal Prices

Steel Producers

The price of steel is, in part, determined by the cost of coking coal used to smelt the iron into steel. Like coal miners, steelmakers are vulnerable to changing contract prices. In April 2008, steelmakers paid up to 200% more than the average coal price in 2007.[132] The Korean steelmaker Posco paid $285 per metric ton of coking coal while spot prices fell below $150.[133]

Steel Producers

US Steel (X)

AK Steel Holding (AKS)

ArcelorMittal (MT)

Nucor (NUE)

Railroad Companies railroads

Providence and Worcester Railroad Company (PWX)

CSX (CSX)

Norfolk Southern (NSC)

Electric Power and End Users

Similar to steel makers, electric power producers are vulnerable to volatile contract prices. However, they can pass part of the expense onto end users.[134]

Electric Power Producers

American Electric Power Company (AEP)

CenterPoint Energy, Inc (Holding Co) (CNP)

Duke Energy Corporation (DUK)

Entergy (ETR)

Investing in Coal Power

There are several options available for investing in the coal industry.

Buying stock in companies that will benefit from dynamics in the industry

Futures contracts (traded on the New York Mercantile Exchange (NYMEX))

ETFs that offer exposure to companies in the coal industry (examples include Market Vectors Coal ETF (KOL), Powershares Global Coal Portfolio ETF (PKOL))

References

↑ EIA: International Energy Outlook 2008

↑ EIA: Coal Supply and Demand 2007

↑ World Coal Institute Facts

↑ EIA: How Coal is Used

↑ EIA: Coal Supply and Demand 2007

↑ Reuters.com:UBS slashes coal price forecasts for 2009, 2010

↑ Energy Kid’s Page, Coal: How Coal was Formed

↑ Energy Kid’s Page, Coal: How Coal was Formed

↑ The Energy Kid’s Page, Coal: Types of Coal

↑ The Energy Kid’s Page, Coal: Types of Coal

↑ The Energy Kid’s Page, Coal: Types of Coal

↑ The Energy Kid’s Page, Coal: Types of Coal

↑ The Energy Kid's Page, Coal: For Making Steel

↑ Energy Kid’s Page, Coal: Where we get Coal

↑ Energy Kid’s Page, Coal: Where we get Coal

↑ Energy Kid’s Page, Coal: Where we get Coal

↑ Seeking Alpha: Expert: Coal Reserves Way to High, December 2008

↑ Seeking Alpha: Expert: Coal Reserves Way to High, December 2008

↑ Seeking Alpha: Expert: Coal Reserves Way to High, December 2008

↑ Energy Kid’s Page, Coal: How We Get Coal

↑ Energy Kid’s Page, Coal: How We Get Coal

↑ EIA: U.S. Coal Expors and Imports, 2007

↑ BP: Coal Production

↑ http://www.philly.com/inquirer/local/20100830_Pennsylvania_coal_plants_face_big_changes_under_planned_EPA_pollution-control_rules.html?page=2&c=y philly.com: Pennsylvania coal plants face big changes under planned EPA pollution-control rules, August 2010]

↑ http://www.philly.com/inquirer/local/20100830_Pennsylvania_coal_plants_face_big_changes_under_planned_EPA_pollution-control_rules.html?page=2&c=y philly.com: Pennsylvania coal plants face big changes under planned EPA pollution-control rules, August 2010]

↑ http://www.philly.com/inquirer/local/20100830_Pennsylvania_coal_plants_face_big_changes_under_planned_EPA_pollution-control_rules.html?page=2&c=y philly.com: Pennsylvania coal plants face big changes under planned EPA pollution-control rules, August 2010]

↑ http://www.philly.com/inquirer/local/20100830_Pennsylvania_coal_plants_face_big_changes_under_planned_EPA_pollution-control_rules.html?page=2&c=y philly.com: Pennsylvania coal plants face big changes under planned EPA pollution-control rules, August 2010]

↑ http://www.philly.com/inquirer/local/20100830_Pennsylvania_coal_plants_face_big_changes_under_planned_EPA_pollution-control_rules.html?page=2&c=y philly.com: Pennsylvania coal plants face big changes under planned EPA pollution-control rules, August 2010]

↑ uk.reuters.com: China power firms seek coal imports, supply scarce, January 2010

↑ uk.reuters.com: China power firms seek coal imports, supply scarce, January 2010

↑ uk.reuters.com: China power firms seek coal imports, supply scarce, January 2010

↑ WSJ: Ill Winds: China’s Wind-Power Push Means More Coal, September 2009

↑ WSJ: Ill Winds: China’s Wind-Power Push Means More Coal, September 2009

↑ WSJ: Ill Winds: China’s Wind-Power Push Means More Coal, September 2009

↑ WSJ: Ill Winds: China’s Wind-Power Push Means More Coal, September 2009

↑ EIA: International energy Outlook, 2008

↑ EIA: Electric Power Monthly, January 2009

↑ EIA: How Coal is Used

↑ EIA: Energy Outlook 2007

↑ EIA: Electric Power Monthly, January 2009

↑ EIA: Energy Outlook 2007, Overview

↑ EIA: Short Term Energy Outlook, Coal

↑ Seeking Alpha: Could Coal Recover, December 2008

↑ Seeking Alpha: Could Coal Recover, December 2008

↑ Seeking Alpha: Could Coal Recover, December 2008

↑ EIA: Short Term Energy Outlook

↑ Seeking Alpha: Could Coal Recover, December 2008

↑ Seeking Alpha: Could Coal Recover, December 2008

↑ Reuters.com:UBS slashes coal price forecasts for 2009, 2010

↑ EIA: Short Term Energy Outlook, Coal

↑ EIA: Short Term Energy Outlook, Coal

↑ International Energy Outlook, 2008

↑ EIA: International Energy Outlook 2008

↑ International Energy Outlook, 2008

↑ MSN.com: The Case for Coal 2009

↑ EIA: U.S. Coal Supply and Demand, 2007

↑ Financial Times: Global electricity use forecast to fall, May 2009

↑ WSJ: Once-Hot Coal Piles Up as Demand Cools, July 2009

↑ WSJ: Once-Hot Coal Piles Up as Demand Cools, July 2009

↑ WSJ: Once-Hot Coal Piles Up as Demand Cools, July 2009

↑ WSJ: Once-Hot Coal Piles Up as Demand Cools, July 2009

↑ Financial Times: Global electricity use forecast to fall, May 2009

↑ Financial Times: Global electricity use forecast to fall, May 2009

↑ Financial Times: Global electricity use forecast to fall, May 2009

↑ WSJ: Coal Glut Rocks Mining Companies, November 2009

↑ WSJ: Coal Glut Rocks Mining Companies, November 2009

↑ WSJ: Coal Glut Rocks Mining Companies, November 2009

↑ WSJ: Coal Glut Rocks Mining Companies, November 2009

↑ WSJ: Coal Glut Rocks Mining Companies, November 2009

↑ EIA: Household Electricity Uses

↑ EIA: Appliance Report

↑ U.S. Coal Supply and Demand, 2007

↑ U.S. Coal Supply and Demand, 2007

↑ U.S. Coal Supply and Demand, 2007

↑ Reuters: AEP sees carbon capture from coal ready by 2015, June 2009

↑ Reuters: AEP sees carbon capture from coal ready by 2015, June 2009

↑ Reuters: AEP sees carbon capture from coal ready by 2015, June 2009

↑ Reuters: AEP sees carbon capture from coal ready by 2015, June 2009

↑ EIA: Energy Outlook, 2007

↑ WSJ: A Better Climate for Natural-Gas Sector, January 2009

↑ WSJ: A Better Climate for Natural-Gas Sector, January 2009

↑ EIA: U.S. Coal Supply and Demand 2007

↑ WSJ: A Better Climate for Natural-Gas Sector, January 2009

↑ WSJ: A Better Climate for Natural-Gas Sector, January 2009

↑ Businessweek.com: Lower Gas Prices Create Competition for Coal, BP’s Ruehl Says, Feb 2010

↑ Businessweek.com: Lower Gas Prices Create Competition for Coal, BP’s Ruehl Says, Feb 2010

↑ Businessweek.com: Lower Gas Prices Create Competition for Coal, BP’s Ruehl Says, Feb 2010

↑ Businessweek.com: Lower Gas Prices Create Competition for Coal, BP’s Ruehl Says, Feb 2010

↑ NASDAQ: Nuclear Power Cheaper Than Coal When Finance Costs Low - IEA, March 2010

↑ NASDAQ: Nuclear Power Cheaper Than Coal When Finance Costs Low - IEA, March 2010

↑ NASDAQ: Nuclear Power Cheaper Than Coal When Finance Costs Low - IEA, March 2010

↑ Montana Environmental Information Center

↑ Suzlon FY 07-08 Annual Report, Management Discussion and Analysis, p. 5

↑ WSJ: Coal Falls Out of Favor as Utilities Go 'Green', April 2010

↑ WSJ: Coal Falls Out of Favor as Utilities Go 'Green', April 2010

↑ WSJ: Coal Falls Out of Favor as Utilities Go 'Green', April 2010

↑ WSJ: Coal Falls Out of Favor as Utilities Go 'Green', April 2010

↑ WSJ: Coal Falls Out of Favor as Utilities Go 'Green', April 2010

↑ WSJ: Coal Falls Out of Favor as Utilities Go 'Green', April 2010

↑ WSJ: Coal Falls Out of Favor as Utilities Go 'Green', April 2010

↑ Seeking Alpha: Could Coal Recover, December 2008

↑ WSJ: A Better Climate for Natural-Gas Sector, January 2009

↑ WSJ: A Better Climate for Natural-Gas Sector, January 2009

↑ NY Times: Steel Industry, in Slump, Looks to Federal Stimulus, January 2009

↑ Phoenix Business Journal: House Dems offer their version of Obama stimulus, January 2009

↑ Department of Energy: Clean Coal Initiative

↑ Department of Energy: Clean Coal Initiative

↑ CNET:Obama's energy pick endorses nukes, clean coal, January 2009

↑ Seeking Alpha: Growth of 'Clean Coal' as Energy Source Faces Challenge, March 26

↑ Seeking Alpha: Growth of 'Clean Coal' as Energy Source Faces Challenge, March 26

↑ Seeking Alpha: Growth of 'Clean Coal' as Energy Source Faces Challenge, March 26

↑ Seeking Alpha: Liquid Coal, Four Stocks to Watch, December 2006

↑ Seeking Alpha: Liquid Coal, Four Stocks to Watch, December 2006

↑ Seeking Alpha: Liquid Coal, Four Stocks to Watch, December 2006

↑ gas2.org: Air Force will be Coal Powered by 2011

↑ ABC News: Clean coal power 20 years away, October 2009

↑ ABC News: Clean coal power 20 years away, October 2009

↑ ABC News: Clean coal power 20 years away, October 2009

↑ ABC News: Clean coal power 20 years away, October 2009

↑ EIA: International Energy Outlook, 2008

↑ EIA: International Energy Outlook, 2008

↑ International Herald Daily: China reduces coal export quotas for the year, March 2008

↑ EIA: International Energy Outlook, 2008

↑ Seekingalpha: Railway Stocks Haul Transportation, August 2008

↑ Alpha.com/article/91868-railway-stocks-haul-transportation-etf-to-solid-returns Seekingalpha: Railway Stocks Haul Transportation, August 2008

↑ Seeking Alpha: Railway Stocks Haul Transportation, August 2008

↑ Energy Information Administration

↑ Seeking Alpha: Coal Could Recover, January 2009

↑ Could Coal Recover, January 2009

↑ Could Coal Recover, January 2009

↑ WSJ: A Better Climate for Natural Gas, December 2008

↑ Seeking Alpha: Could Coal Recover, December 2008

↑ Seeking Alpha: Could Coal Recover, December 2008

↑ Seeking Alpha: Could Coal Recover

carbon dioxide, carbon emissions, power sector, sulfur scrubbers, license renewal, california, inexpensive, coke, industrial output, prices drop, construction projects, mining shaft, source of electricity, carbon tax