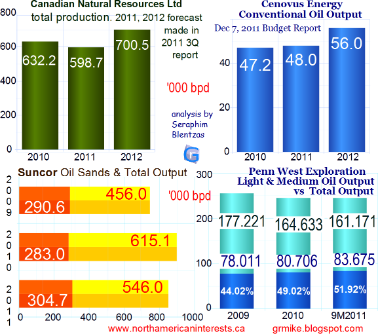

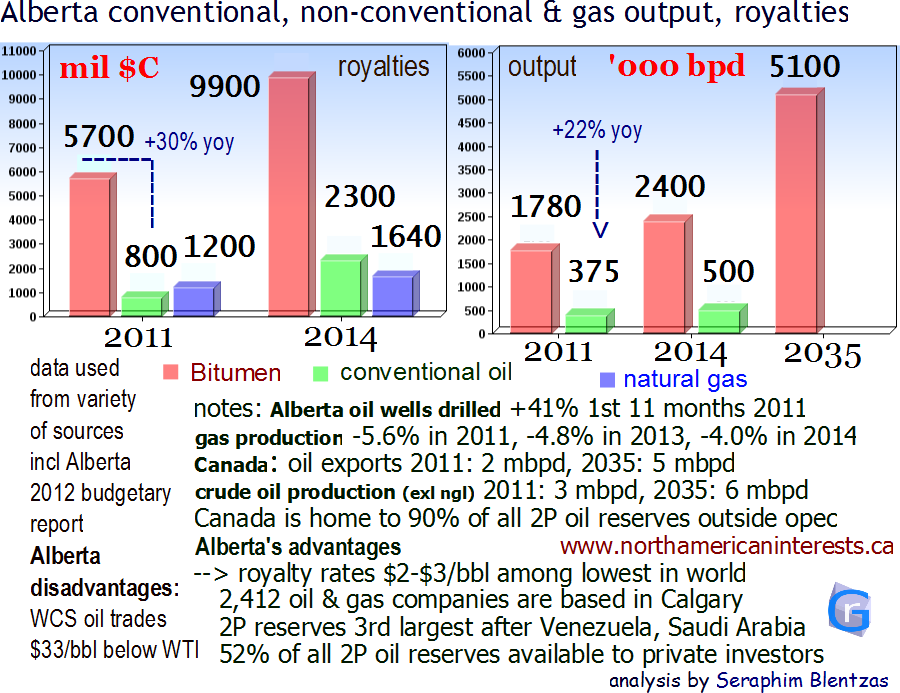

Total oil production in Alberta will reach 3M bpd in 2014, 3.3M bpd in 2019. 2.4M bdp of 2014 production will be non-conventional bitumen with the rest conventional. 2011-2012: non-conventional oil production in the province was 1.78 million barrels per day. Conventional oil production will reach 500,000 bpd by 2013; In just 2011, conventional oil output grew by 70 kbpd which translates into the biggest year on year growth in over a decade for medium light oil, that trend is likely to continue into the near future. The last time conventional oil was produced at a rate higher than it was in 2011 was back in 2006; output in 2002 was over 450 kbpd. (data comes from Alberta's 2012 budget report). Alberta's royalty revenue: Bitumen contributed $5.7B in royalty payments to the province in 2011 +30% or $1.3B higher than in 2010. At its current rate of increase of 32% per year it will reach $9.9 billion in 2014. Total royalty payments incl conventional oil was $6.5B in 2011 and will be around $12.2B in 2014.

Disadvantages associated with Alberta's oil: As Western Canadian Select crude it trades at a $33 discount to WTI (American). It doesn't help either that 55% of Canadian oil exports go to an area in the midwest known as Padd II; Refineries in Padd II already have a glut of oil and that depresses the price of WCS oil.

Approximately 20% of Alberta's oil sands are close enough to the surface to be recovered by open pit mining, the rest requires vairous in-situ technologies; the government of Alberta requires that oil companies bring the land back to equivalent land capability' that is, restore it to a level that makes it useful to the community either as boreal forest (which was initially destroyed) or pasture for bison (though many companies have only restored a fraction of that, for example Syncrude Oil restored 22%). Oil sands operations have been approved to use about 360 million m3 of water from the Athabasca River (runs through the mining district, water source is a glacier over 1,200 km away), that's twice as much water used by the entire city of Calgary though less than 1% of the water from the river is used by the province and oil operations; 24 m3 of water is used to produce 1 m3 of synthetic oil.

By 2045 oil sands will produce close to 11M bbls/d and that will continue for a century. Between 2012 and 2020 oil output from the tar sands will double (1.7 mbpd --> 3.4 mbpd) and triple over the next 25 years to 5.1 million barrels per day. Tar sands crude is over five times more expensive to extract than middle east oil however with oil prices up more than 400% since 2001 and Alberta continuing to charge one of the lowest royalty rates in the world (fell from $3 to $2/bbl between 2001 and 2009) there is much profit to be made.

90% of global conventional oil reserves are controlled by state owned oil companies and that makes Alberta even more attractive to private investors (that makes Alberta home to 52% of all oil 2P reserves (including heaviest/unconventional) available to private investors, even 'public' companies like Ecopetrol only make available 10-20% of company shares to private invesment). However Canada is home to 90% of the world's reserves outside of OPEC and that makes Canadian oil even more attractive to prospective investors.

44% of crude oil processed at Canadian refineries comes from international sources, something that's bound to change given that 1. A lot of the foreign oil is purchased at higher prices than oilsands oil and 2. Oilsands producers are in need of Eastern Canada's oil refining capacity. In order for Eastern Canada to become a market for Alberta's oil there needs to be a drastic improvement of pipeline infrastructure and refineries need to be fitted with technology that allows them to process more heavy oil.

Alberta's economic success in this area has come at a price; Alberta has the highest percentage of workers living in social housing. Inflation is also high.

In fiscal 2011 $13.001b of Suncor's 39.337b in revenue came from the oil sands (33.0%) up from $9.7/$32b the year before (30%).

The oil sands are on track to account for 88% of Alberta's oil production by 2017, up from 64% in 2007. Including both conventional and unconventional sources Alberta holds 98% of Canada's reserves.

Many of the smaller Canadian companies lack the billions needed to extract the oil and that has created opportunity for foreign companies such as Norway's Stat Oil, which has shown a lot of interest in the oil sands (Stat Oil's assets in Venezuela have been taken away by Chavez while their core reserves in the North Sea are nearing depletion. Fort McMurray is at the epicenter of Alberta's oil boom. (More info on oil supply and demand) New Brunswick has also become a hotbed of activity due to the presence of natural gas containing rock; the American company that's taken an interest in it has sparked a backlash in the province against gas exploration (environmental consequences of fracking).

Offshore platform emissions at Statoil were reduced by 65% due to the company's new carbon storage technology. Statoil was estabslished in 1972 in a bid by Norway to control the nation's resource. Profit made was invested in a pension fund that has since grown in size to over $380 billion dollars.

Interesting Fact:

Just over half of the world's oil rigs are currently in use in North America (2100 out of about 4000) despite the fact that North America accounts for only 15% of the world's oil output.

Notes:

November 2013: Canada's National Energy Board estimates Canadian oil production to rise by 75% between the years 2014 and 2035 to 5.8 million barrels per day. However demand for oil in Canada will be only 20% higher due to more efficient use per unit. This means that Canada needs more pipelines to connect its oil to international markets where demand will rise the most.. China ! In September 2013 Chinese oil imports surpassed that of the USA (6.3m bpd vs 6.1m bpd). remember, China still lags the US in terms of total consumption (12.5 vs 18.7mbpd) but the US is producing more while reducing total consumption while in China domestic oil output has stalled at 4.6m bpd.

August 1, 2013 : TransCanada Pipelines announces a $12 billion pipeline project from that will carry oil from Alberta to Saint John, New Brunswick. Its capacity will be over 1m boe/d (upped from 850th), will cost $12b and will use 3000 km of existing pipeline from Alberta to Quebec. The project is a joint venture with Irving Ltd. The tail end of the pipeline will be an Irving Export Port capable of handling excess oil cargos destined for overseas markets.

On Friday August 31, 2012 Kuwait Petroleum Corp initiated a $4 billion investment deal that will see it take a 50% interest in Athabasca's Hangingstone and Birch properties. The other company involved is Athabasca Oil Corp -stock up +8.56% on the day to $13.57.

According to the government, Alberta is the only state or province in North America to impose mandatory Greenhouse Gas Emission reduction targets on top emitters.

On Nov 17, 2012 a Halifax MP travelled to the Alberta Oil Sands with the message that Alberta oil is welcome in Eastern Canada. The maritime provinces in particular rely on oil imports from the Middle East because there aren't any pipelines to carry oil from Western Canada east. Another thing to note here is that in the West, there aren't many oil refineries (newest one is 30 years old). Eastern Canada is home to Canada's largest oil refinery (300,000 bpd Irving refinery in Saint John originally managed by Chevron) as well as others in Newfoundland (115,000 bpd) and Dartmouth (89,000 bpd). The refineries are backed by large companies (Irving, Imperial Oil, Exxon).

Alberta is home to nearly 170 billion barrels of proven and probable oil reserves (much of it amongst easily processed oil sand) exceeded only by Saudi Arabia and Venezuela. (AP:China eyes Canada oil, US's energy nest egg) In Alberta alone, more than 1.6 trillion barrels of oil in inferred resource isn't even included because extraction methods SAGD and THAI/CAPRI aren't able to bring it to the surface by economically viable means. There's also a new method utilizing Wedge WellTM Technology (horizontal pairs of steam assisted wells) used by Cenovus Energy at Foster Creek for 12% of all production (38 wells with 13 more coming on tap in the 4th qtr) which reaches oil otherwise unreachable (production growth at Cenovus actually relied on that in the third quarter of 2011). Considering only conventional sources, Canada has major sources outside Alberta (Saskatchewan and Newfoundland combined have about 1.4 times as much oil reserves as Alberta). (NEB - Energy Reports Canadian Energy Overview) more on Cenovus Energy