research and analysis by SERAPHIM BLENTZAS dalhousie university

Ecopetrol (TSX:ECP, NYSE:EC, BVC:ECOPETROL) is a Colombian publicly traded, state run (89% government owned) vertically integrated (meaning it's also significantly active in refining, marketing and transportation) petroleum, petrochemical and gas company. It is a large integrated oil company in the business of refining, producing and marketing crude oil, natural gas and petrochemical products with the distinction of being Latin America's 4th largest oil producer.[1][2] The company has strong domestic backing not only from the government of the country it does most of its business in but also the people with at least 480,000 Colombian citizens as shareholders;[3]

Between July 27 and August 17, 2011 Ecopetrol held a share sale in which it sold approximately 4% of the company to independent Colombian investors (but has the government's authorization to sell 9.9%) with proceeds raised expected to be in the range of $1.71 billion to $5.89 billion. The Colombian government authorized Ecopetrol to sell 20.1% interest in the company to the public however only one share issuance was made since 2007 and that was for 9.9% (raised $3.24 billion).[2]

Most of its revenue comes from Colombia where it oversees much of the country's oil and gas operations (refining and marketing). It produces crude oil throughout the country and has an 8,500 km long pipeline network which gives it extensive access to regional markets nationwide. It also has key partnerships with other major petroleum companies (Pacific Rubiales Energy, Talisman, Total among others) as well as scientific research and development laboratories (ICP). Exploration activities are conducted in 47 blocks in Colombia (15 of which are joint ventures with other companies). In 2009 Ecopetrol was responsible for 63% of all oil and gas production (426 of 672 kbpd) in Colombia (production in the country is up 18% the last year; proven-probable-possible reserves are up to 3.1 billion barrels).[4][5] With over 480,000 Colombian citizens as shareholders (not including share sale in the summer of 2011) and strong backing by the government (which runs the company) Ecopetrol has strong domestic support which is important since Colombia is where it does most of its business (over 80% of production and all refining business is done in Colombia). The company also does business in the Gulf of Mexico, Brazil and Peru. In April 2010 had the 15th highest market value among oil companies.[6] In 2010 Colombia produced 17.1% more petroleum than it did in 2009 (up to 786,000 boe/d from 671,000 boe/d) a record increase for the country; the same year Ecopetrol's production rose at a similar pace (up to 615,900 boe/d from 520,000/d in 2009) ; domestic policies in Colombia greatly impact Ecopetrol.

In September 2010 Ecopetrol started producing at its first hydro treatment-clean fuel production facility at Barrancabermeja. In accordance with new industrywide guidelines its purpose it keep sulfur concentration of petroleum products at a minimum (300 ppm for gasoline, 50 - 500 ppm for diesel). The hydro treatment plant at Barrancabermeja refinery required an investment of $1 billion by Ecopetrol.[7] By June 2010 the plant was operating at 98%.

In October 2010 it deepened its partnership with bio technology maker Solazyme by committing to the development of microalgae derived biofuel.[8]

By the end of 2009 the amount of product exported was 40% higher (a quarter of crude oil was used in China, half as much as was used in Singapore and Rotterdam, exports make up about half of revenue). As of January 2010 the company was also trading on the Lima Stock Exchange a couple months before it joined the Toronto Stock Exchange (Ecopetrol was the first Colombian company to list on the TSX).[9]

Company Overview

International operations are run by 3 divisions, Ecopetrol Oleo e Gas do Brasil Ltd., Ecopetrol del Peru, and Ecopetrol America inc (operates 22 blocks in the Gulf of Mexico). The company has 2 refineries in Colombia; Barrancabermeja (the country's largest) and Cartagena. Through its association with the Colombian Petroleum Institute it has research and development agreements with universities, and also runs its own corporate university as a training center for workers. The company's portfolio grew by 31% in 2009 due to the start of a $6.3 billion dollar investment plan (90% of which is in Colombia) and acquisitions which included a 50% interest in Savia Peru (major Peruvian oil company). Subsidiary Ecopetrol America increased its presence in the Gulf of Mexico by 22 blocks for a total of 101 blocks. Investments abroad were routed through Ecopetrol Global Energy SLU of Spain in 2009. For 2010 about 18% of investment in South America (not including Colombia) is estimated to be in Peru (where it has five exploratory blocks mostly in the Maranon (four) and Ucayali (one) basins. Ecopetrol strengthened its hold of Ocensa, a major pipeline company by acquiring 24.7% of it from Enbridge, a major North American pipeline operator for $417.8 million. The additional interest made Ocensa a subsidiary of Ecopetrol (Ecopetrol's ownership went from 35.3% to 60%). At the time the Ocensa pipeline was 829 km long, it connects to Colombia's largest oil producing region and the Cenovas export port on the Carribbean cost.[10] Ecopetrol is also partnered with Chevron which operates the Chuchupa and Ballena natural gas Fields (average sales of 67,945, Ecopetrol's direct interest in natural gas rose 5% to 97,438 boe/d in 2010).

Sales increases in Colombia in the first half of 2010 were mostly from Natural gas (El Nino effects) and medium distillates (increased demand from transport systems and jet fuel consumers), they were 47.5% and 30.1% higher than the year before (revenue from Colombia increased COP 163.5 billion, 88.5% of total revenue increases are due to higher oil prices).[11] Abroad a 40.4% rise in Castilla crude oil exports boosted crude oil sales to markets outside Colombia (prices were 30.9% higher than the corresponding period in 2009). In the first half of 2010 46.5% of sales growth was from business abroad. In the first half of 2011 international business accounted for 56.2% of all sales up from 46.9% the year before.[12]

Production of oil and gas totalled 655,100 bpd in the first six months of 2011, an 18% increase over the corresponding period in 2010 (555,400 bpd); All of the increase came from crude oil (rose 21.6%) with natural gas steady at 97,100 bpd. Results in the second quarter were better than the first (natural gas actually increased 1.9% crude oil 24.4% overall increase 20.6%). 106,300 bpd of the 655,100 bpd 1h11 production went to royalties, representing a 21.8% increase versus 1h10 (royalties increased more in the second quarter 24.8%). Production in the second quarter increased 20.6% reaching an average of 674,400 bpd with total corporate group production up 22.3% to 727,200 bpd (minor subsidiaries included) including beginning production at Equion (7,200 bpd crude oil/6,600 bpd natural gas) and 20.3% increase at Hocol (30,200 bpd crude oil/no ngas though). For the first half corporate group production averaged 707,300 (up 19.9%).[12] In the third quarter of 2010 production averaged 632,100 barrels of oil equivalent per day which is 16.4% higher than in the third quarter of 2009.[13]

About 10.1% of the company has been made available for ownership to the public (issued in 2007) with an additional 4% expected to be made available for investors in July/August 2011. At the time of the 2011 share issuance Colombia's largest brokerage, Interbolsa called the stock "sharply undervalued" (stock was 33% lower than Interbolsa's end of year estimate).[2] In June/July 2011 Ecopetrol was forced to liquidate some of its portfolio as a result of subsidiary Refineria del Nare S.A Refinare's economic situation, Refinaire was the operator of the Nare refinery which was established in the 1990's (Ecopetrol's initial investment in Nare came in 2003 when oil from the field was handled by Ecopetrol's refinery nearby).[14][15]

Primary subsidiaries and Acquisitions

Ecopetrol Transactions[16]

Year

Partner

Area

mil$US

Interest (%)

Asset Involved

2007 Propilco Colombia 650 100 petrochemical operations bought out

2008 Statoil Hydro Gulf of Mexico 160 20-30 3 drilling properties

2008 ENI S.p.A. Gulf of Mexico 220 20-25 5 drilling properties, exploration, South America

2008 Pacific Rubiales Energy Llanos Orientales NA 55 In the Alicante Basin

2008 Union Oil Company of California Gulf of Mexico 510 9.21 production

2008 Petrobras, Petrogal, Vale Brazil NA 30-37.5 6 exploration contracts (3 projects)

2008 Turkish Petroleum Norte de Santador NA 50% exploration in the Gonzales Basin

2008 Shell offshore Gulf of Mexico NA 25% 2 deepwater basins

2008 Pacific Rubiales Energy Llanos Orientales 300 65 230 km long pipeline linking the Rubiles field

to a pumping facility in Casanare

2008 Bioenergy Llanos Orientales 140 80 fuel alcohol production

2008 Korea National Oil Company Peru 450 50 10 exploration fields, prod field-22,000 bpd

2009 Glencore Colombia 549 51 Cartagena refinery

2009 Hocol Colombia 748 100 27 blocks exploration, production,

32% of Colombia pipeline

2009 Ocensa, Pacific Rubiales Energy Colombia 417.8 24.7 829 km pipeline, 5 pump stations, 1 export dock

2009 Petrobras Peru NA 25-50 2 blocks

2009 Anadarko Petroleum Brazil NA 50 block

2009 Talisman Energy Peru NA 45 block

2010 Talisman Energy Colombia 969 51[17] the Colombia assets formerly belonging to BP

Ecopetrol's primary subsidiaries include

Propilco - Petrochemical producer (acquired in Dec. 2007) that currently controls 95% of the market for polypropylene.[18] Its parent produced 30% of Propilco's propylene consumption in 2009 which reduced costs. Products include masterbatches, homopolymers and different types of copolymers.

Reficar - Operates the Cartagena refinery. The refinery underwent major expansion phases in 2009 which resulted in an income loss for the year. In May 2009 Ecopetrol bought out Glencore's interest in Reficar for a total purchase price of US$ 549 million (51% interest in Reficar).[19] At the same time Ecopetrol paid US$ 742 million to French company Maurel & Prom for Hocol.[20] Glencore is a swiss company.

Ecodiesel S.A. - 50% owned subsidiary that oversees biofuel refining and diesel plants that won't be operational until the first half of 2010 at the earliest.

Bioenergy S.A. - 80.2% owned subsidiary that produces the biofuel ethanol. It began with a $140 million investment in a plant producing carburating alcohol from sugar cane in the province of Meta, where 11,000 hectares of land are being conditioned (isn't operational yet).[21]

Ocensa - (Total and BP also have stakes in the company) Operates 829 km of pipeline with a transport capability of 650,000 b/d as well as 5 pumping stations and a shipment port.[22] The subsidiary experienced a 40.74% increase in volume transported in the 2nd half compared to the 1st half of 2009 due to Rubiales oil field production increases (Ecopetrol's partner there, Pacific Rubiales Energy which has a contract with ocensa to use their pipeline, plans to invest $1.2 billion to expand Rubiales oil field over the next 2 years.[23]

Oleoducto de los Llanos Orientales - Operates a crude oil transportation network, raised $500 million in 2009 to finance expansions.

Hocol - Petroleum producer at numerous locations, some projects are joint ventures with Total and Talisman Energy. Production rose 41% during fiscal 2009 and 20.3% in the second quarter of 2011 (to just over 30,000 bpd of oil and natural gas). Hocol was purchased from France's Maurel & Prom for US$ 742 million (US$ 580 million in cash and $162 million in working capital).[20]

Offshore International Group - Jointly owned with Korea National Oil Corporation (Ecopetrol has 50% of the company), announced $2.5 billion in investments over the 8 years to raise production

Others are Equion, Savia and Ecopetrol America. For the first half of 2011 total corporate group production came from Ecopetrol parent (92.5% down from 94.1% in 1h10)), Hocol (4.4% up from 4.3%), Equion (1.8% up from 0%), Savia (1% down from 1.2%) and Ecopetrol America (0.28% down from 0.34%); subsidiary production increased by 37.6% in the second quarter of 2011.[12]

Business and Financials

2011 first half

Error creating thumbnail

Hedging practices contributed a loss of COP$531 billion which when combined with losses from equity tax & surcharge and positive results from other revenues and dividend earnings, non-operating costs increased by a total of COP$143.9 billion (first half). In the second quarter alone, revenue was 51.3% higher rising to COP$13.8219 trillion (while cost of sales were up only 30.4% to COP$7.65 trillion). The positive results are attributable to a 51.2% rise in the price of exported crude, 44.1% rise for exported petroleum products, 30.1% increase in sales volume counteracted by a 7.11% change in the value of the Colombian Peso in American dollars. Cost of sales rose due to larger purchases of crude (1,980 MBLS) and more imports of increasingly expensive naphtha solvents used to transport heavy crude (1,331 MBLS), turbofuel and gasolines. Lowering costs were low low sulfur content diesel imports as well as more money coming from minority investments (they increased in value and so consequently, ammortization increased). Fixed costs were 20.1% higher coming from maintenance activity of transport systems and contracted services. Total assets increased in value by 13.7% (up to COP$ 74.0319 trillion); COP$4.8682 trillion of the increase (current assets contributed 54% of the increase in total assets). Shareholders equity only increased 1.5%. Financials were boosted by a 9.5% rise in the second quarter regulated price of gas; average oil and gas prices were up across the board when compared to the first half of 2010 (WTI up 25.5% to $98.4/BBL, export crude oil up 37.9% to $96.7/BBL (up 51.2% to $104.2/BBL in the second quarter), exports products up 36.4% to $94.5/BBL and natural gas up 50% to $4.2/MMBTU. In the first half of 2011 international business accounted for 56.2% of all sales up from 46.9% the year before.[12]

2011 2nd Quarter - Net earnings were COP$3.403 trillion for the exploration and production business unit (up 68%, up 69% for the half), COP-$105 billion (improved by 125 billion) for refining and petrochemicals (net loss for the half was COP$220 billion lower due to improved prices for refined products) and COP$153 billion for transportation (down 13%). Transportation revenue increased due to expansions by the Ocensa pipeline and field, higher overall volumes and initial production at Poliducto Andino.

2011 updates

About 4% interest in the company was made available to private investors in July/August 2011 (the government has allocated about 20% total private investment involvement (available only to the people of Colombia), only 10.1% had been officially issued (in 2007). At the time of the 2011 share issuance Colombia's largest brokerage, Interbolsa called the stock "sharply undervalued" (stock was 33% lower than Interbolsa's end of year estimate).[2] In June/July 2011 Ecopetrol was forced to liquidate some of its portfolio as a result of subsidiary Refineria del Nare S.A Refinare's economic situation, Refinaire was the operator of the Nare refinery which was established in the 1990's.[14][15]

2010 and 2009

Due to risks associated with the Colombian Peso, Ecopetrol ran a COP23.4 billion non operating results loss in 2009 related to fluctuating exchange rates (in US dollars annual sales were down to 14.26 billion in 2009 compared to 15.42 billion in 2008).[24][6] Recent unsuccessful explorations have taken a toll on operating income, being a major contributor to an increase in expenses by 19% in 2009.[25] The 10.1% of the company's shares not held by the government belong to pension funds (3.89%), individuals (5.17%), foreign companies and funds (0.13%), other companies (0.81%), and ECP APR Program Fund (0.09%). Demand for 144-A bonds issued on the NYSE was 5 times higher than what was issued (COP1.5 trillion).

In the first part of 2009 it gained access to a bank loan worth COB 2.2 trillion and for the rest of the year it was the most popular stock on the Colombia Stock Exchange. Impacting margins were costs and oil prices. Even though prices (and total revenue) were lower (prices down 30-40%) costs rose (24% for hydrocarbon transport services, 34% for materials and chemicals, 12% for labor and maintenance). The main expense that fell in cost were taxes a direct result of lower sales (by COP 30 billion). For fiscal 2009 ebitda was 29.25% smaller (ebitda margin was 7% lower going from 45 to 38 percent). Employees increased by 178 resulting in higher staff expense. 90% of operating expenses were royalty crude, income tax, and dividends that went mostly to the government of Colombia and shareholders. There's also a capex program in which it plans on spending up to $80 billion over the second decade of the millenium.[26] In May 2009 Ecopetrol acquires Glencore's shares in Reficar. Also that month, it acquired subsidiary Hocol (30,000 bpd production in the first half of 2010) from French company Maurel & Prom for US$ 742 million.[20]

Error creating thumbnail

Colombian Peso/USD exchange rate

The average foreign exchange rate ratio for the Colombian Peso to the United States Dollar (USD) for each period since 2005 are 2005 2,275.89, 2006 2,856.8, 2007 2013.8, 2008 2302.9, 2009 2154.53563 (averaged out using historical data from x-rates.com), first nine months of 2010 1908.5138 (averaged out using data from x-rates.com).

During the year leading up to June 2010 Ecopetrol had an ebitda of US $7.1 billion (compared to $3.4 billion in debt, the debt to ebitda (ebitda was 74% higher than the year before) and other debt ratios could rise over the short term due to its dividend policy) and $2.5 billion of cash at the end of the period. Revenue was 16.8% higher in 1qfy10 than 1qfy09 however operating margin was lower when considering the second quarter of 2010 (29.5% versus 31.9% in 2qfy09).[26] In 2010 the number of exploratory wells Ecopetrol increased by 19 (steady with the year before however the company doubled its international presence to 6 wells in Peru and Brazil) even though the company spent 49.4% less on exploration (down to US$258 million from US$510 million in 2009); exploration expenditure was the lowest since 2006.[27]

Production

Error creating thumbnail

2010 Average daily production rose sharply by 18.44% to 615,900 boe/d (2010) from 520,000 boe/d (2009). In 2010 248,078 boe/d (83.76%) of production was oil (heavy and light) up from 81.92% in 2009 (the rest is natural gas, 100,000 boe/d in 2010 compared to 94,000 boe/d in 2009) the heavy component acccounted for 210,000 boe/d of the 248,078 boe/d directly produced by Ecopetrol. Although natural gas has steadily/consistently increased since 2006 its share of total production has steady fallen due to much faster growth rates for heavy oil. Heavy crude oil represented 40.7% of the oil production segment (210,000 boe/d up 64,000 boe/d (or 43.84%) from the 2009 (146,000 boe/d); that represents the fastest rate of growth for heavy oil production over a year both in percentage and aggregate terms. The increased production came from the record number of new wells drilled (780).[28] 25,816 boe/d of production came from initial production at the Cupiagua and Cupiagua Sur Fields which the company acquired direct control over in 2010. 579,249 of 615,900 boe/d of oil and 97,438 of 100,000 boe/d of natural gas was directly operated by the parent company with interests in Hocol and Savia accounting for the rest. Ecopetrol also inherited 100% control of the Tibu project (20,000 boe/d by 2015).

The contribution to Ecopetrol's share of petroleum (heavy oil) production by Ecopetrol's affiliates rose sharply in 2009, making up only 0.28% in 2008 but 4.9% of ecopetrol's total petroleum production in 2009 (contribution by affiliates went from 1000 bpd in 2008 to 21,000 bpd in 2009). That contrasts with Ecopetrol's direct petroleum production growth which was 12% in 2009. Production by the assets purchased from British Petroleum, 27,000 in early 2010, is forecast to double within five years. Although the company planned on producing 615,000-620,000 barrels of oil equivalent per day by the begining of 2011 it had already surpassed that mark in the third quarter of 2010 when production averaged 632,100 barrels of oil equivalent per day.[13][29] Much of the growth in heavy crude production was made by fields in Chichimene and Castilla.[30]

Oil and gas production[31]

(000 boe/d)

2005 2006 2007 2008 2009 08/09

%change 2010[28] 09/10

%change 1hfy10

3qfy10 2011 hlf

Petroleum and gas

Total 376 385 399 447 520 16.3% 615.9 18.4% 589.3[30][32]

632.1[13][29] 655.1

Petroleum alone 311 316 327 362 426 17.7% 515.9 21.1% 294.8

Heavy Crude 60 69 82 109 146 33.9% 210 43.8% 263.2

Natural Gas 65 69 72 85 94.6 11.29% 100 5.7% 97.1

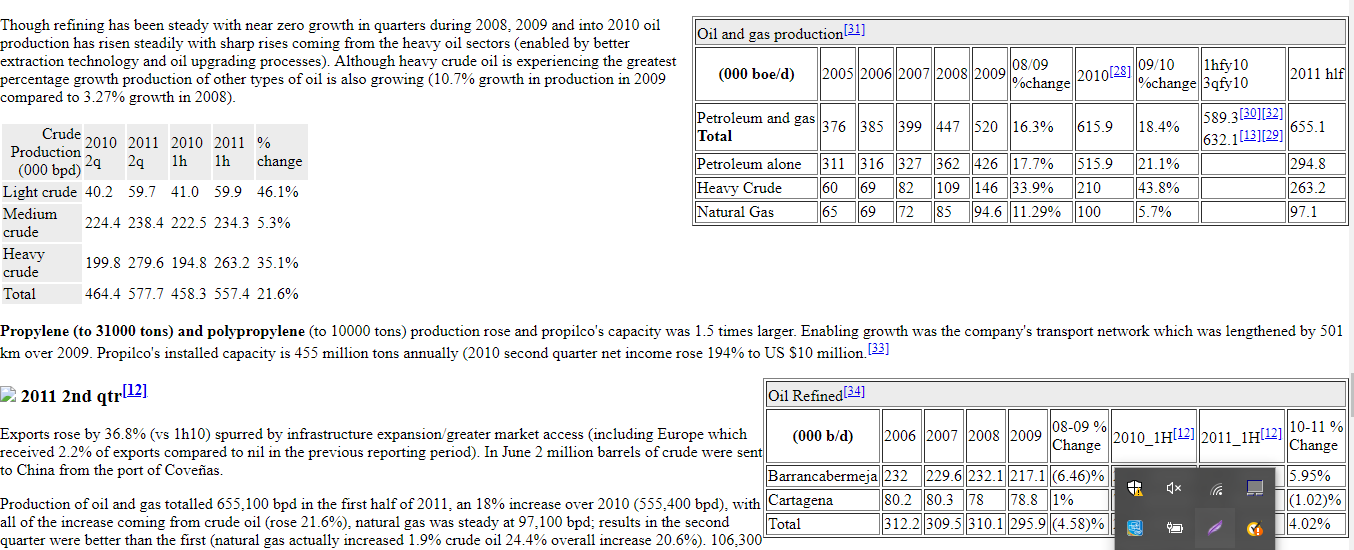

Though refining has been steady with near zero growth in quarters during 2008, 2009 and into 2010 oil production has risen steadily with sharp rises coming from the heavy oil sectors (enabled by better extraction technology and oil upgrading processes). Although heavy crude oil is experiencing the greatest percentage growth production of other types of oil is also growing (10.7% growth in production in 2009 compared to 3.27% growth in 2008).

Crude Production (000 bpd) 2010 2q 2011 2q 2010 1h 2011 1h % change

Light crude 40.2 59.7 41.0 59.9 46.1%

Medium crude 224.4 238.4 222.5 234.3 5.3%

Heavy crude 199.8 279.6 194.8 263.2 35.1%

Total 464.4 577.7 458.3 557.4 21.6%

Propylene (to 31000 tons) and polypropylene (to 10000 tons) production rose and propilco's capacity was 1.5 times larger. Enabling growth was the company's transport network which was lengthened by 501 km over 2009. Propilco's installed capacity is 455 million tons annually (2010 second quarter net income rose 194% to US $10 million.[33]

Oil Refined[34]

(000 b/d)

2006 2007 2008 2009 08-09 %

Change 2010_1H[12] 2011_1H[12] 10-11 %

Change

Barrancabermeja 232 229.6 232.1 217.1 (6.46)% 216.9 229.8 5.95%

Cartagena 80.2 80.3 78 78.8 1% 78.6 77.8 (1.02)%

Total 312.2 309.5 310.1 295.9 (4.58)% 295.7 307.6 4.02%

2011 2nd qtr[12]

Exports rose by 36.8% (vs 1h10) spurred by infrastructure expansion/greater market access (including Europe which received 2.2% of exports compared to nil in the previous reporting period). In June 2 million barrels of crude were sent to China from the port of Coveñas.

Production of oil and gas totalled 655,100 bpd in the first half of 2011, an 18% increase over 2010 (555,400 bpd), with all of the increase coming from crude oil (rose 21.6%), natural gas was steady at 97,100 bpd; results in the second quarter were better than the first (natural gas actually increased 1.9% crude oil 24.4% overall increase 20.6%). 106,300 bpd of the 655,100 bpd 1h11 production went to royalties, representing a 21.8% increase versus 1h10 (royalties increased more in the second quarter 24.8%). Production in the second quarter increased 20.6% reaching an average of 674,400 bpd with total corporate group production up 22.3% to 727,200 bpd (minor subsidiaries included) including beginning production at Equion (7,200 bpd crude oil/6,600 bpd natural gas) and 20.3% increase at Hocol (30,200 bpd crude oil/no ngas though). For the first half corporate group production averaged 707,300 (up 19.9%).

Because royalties were paid at a slightly higher rate for crude oil, net oil and gas production increased less than total production (17.2% compared to 18%) (natural gas royalties fell 0.9% even though production increased 0.6%). Ecopetrol's oil purchases rose slightly to 224,400 bpd (up 2%).

Sales and Export Destinations - Ecopetrol purchased 224.4 bpd of crude, natural gas, and petroleum products (increase of 2%, increase of 7.6% to 234,700 bpd in the 2nd qtr) meaning Ecopetrol sold over 800 thousand bpd of petroleum (production + purchases). The total sales volume of 824,900 bpd (up 14% most of the increase coming from Castilla crude (crude oil made up 77% of the the rise in export volume (96/124.7 bpd)) went mostly to the US Gulf Coast, Caribbean and Far East. 47.1% of crude oil exports went to the US Gulf Coast (down from 59.1% in 1h10), 27.2% to the Far East (up from 22.3), 11.5% to the US West Coast (up from 5.6%), 5% to Europe + the Caribbean (up from 0%), 1.7% to Central America (down from 5.9%); Canada (0.7% from 1%) and Africa (0% from 1%) were lower. The Caribbean leaped ahead of the US Gulf Coast and the Far East as an export destination for petroleum products (36.% up from 3.6%). Products exports were up because of underperformance in the previous period (Barrancabermeja refinery/Magdalena River problems) and a rise in fuel-oil demand. Natural gas exports were spurred by the removal of government restrictions that forced companies to sell domestically only. Domestically, sales fell 7.3% on account of less natural gas available (export markets demanded more of it), supply problems regarding LPG caused by damage to fuel lines, infrastructure problems steming from the closure of roads in the winter affecting fuel-oil demand. In the first half of 2011 international business accounted for 56.2% of all sales up from 46.9% the year before.[12]

Reserves

2010 saw an 11.4% increase in proven oil reserves to 1.714 billion boe (net of royalties which cost 164 million barrels) that compares to 1.538 billion boe reported at the end of 2009; 72% of thoses reserves are crude oil the other 28% natural gas. Including the 164 million boe in royalties gross reserves total 1.878 billion boe. 365 million boe we added to proven reserves (1.93 barrels added for every 1.0 barrels produced making the reserve replacement a stellar 193%). Going back to 2007 proven net reserves have risen 42% from 1.210 billion boe to 1.714 billion boe, also during that time annual net production grew 56% from 121 million boe to 189 million boe. 95% of of the 1.714 billion boe of proven net reserves is directly managed by Ecopetrol with the other 5% managed through Hocol (3%) and Savia in Peru (2%).[27]

2009 saw a 35% increase in proven oil reserves the largest percentage gain since the 1990's[35] though exploration activities had a minimal effect. Most of the increase came from field reevaluations and acquisitions (such as Hocol Colombia which produced 22,000 bpd). 2009 also saw Ecopetrol's reserve replacement rate rise 269% (that means for every barrel produced during the year, 2.69 new barrels were added to reserves) compared to an average of 68% the three years prior.[26] 47% of new reserves came from the region around Castilla and Chichimene (central area) while 22% were from the north east where its main operation is a partnership with British Petroleum. Exploration success rate was 28% (drilling associated with exploration activity cost $164 million US, 3 of the 5 wells were in the Eastern Plains area). Most exploration expense was abroad (about half spent in Brazil and the USA (where in addition to regular drilling it participated in 3 new drills in the Gulf of Mexico).

In early 2011 gross reserves stood at 1.878 billion barrels of oil equivalent (including proven gas reserves of 2942 GPC)[35][36] That compares to 1.40 to 1.538 billion boe in 2008/2009.

Trends & Forces

Oil output in Colombia has increased by about 50 % since 2006, most of that is related to efforts by the country to facilitate increased investment into land surveying research and to oil exploration companies to increase the reserve/resource estimates. By May 2010 at least 83 licenses to explore, produce in Colombia were applied for by petroleum companies including Chinese ones. Because of Ecopetrols extensive network of pipelines and transport infrastructure in the country (some through subsidiary Ocensa) the company could end up with more business and business partnerships with the new companies.[37] Better bitumen extraction technologies (toe to heal air injection, steam assisted and others) will contribute to higher reserves estimates for the country and higher production levels for Ecopetrol.

Colombian politicians have expressed interest in raising revenue from oil and mining companies not by raising tax rates but by encouraging higher investment and production. This is great news for Ecopetrol because the only way royalties would increase is if there is a comparable percentage increase in its earnings and profits.[38] There isn't the kind of cap on profits in Colombia that limit companies based in some other countries. Better security and capitalist friendly regulations provide growth opportunities and a competitive advantage for Ecopetrol over some of its competitors.[39]

Its new oil pipeline and upgrading facility (currently being constructed as part of a $4.2 billion project) at Cenovus port could inevitably see business from other companies in the region many of which are at very early phases of development and could make use of the pipeline and upgrading facility (with a capacity of 450,000 barrels per day by 2012 when it opens).[40]

Oil Prices

Recent trends have been higher reflecting such factors as growing energy demand (higher world population, development in high population/developing countries) and limited non renewable resources (even though countries like Canada and Venezuela are slowly increasing their reserves estimates due to better upgrading processes and extraction technology many other countries don't have significant amounts of bitumen (heavy oil) and so their reserves are falling).

Impact of the International Economic Crisis on Colombia

In Colombia exports were down 12.7% in 2009 due to a weak showing in overall consumption (down 4.5% globally) and strict fiscal and monetary policies in other nations (as recently as 2005-2006 39% of Colombia's exports went to the US). This is significant for Ecopetrol since crude oil accounts for almost 40% of those exports.[41] Measures taken by the Colombian government to counteract negative growth stabilized gross internal product but not inflation (2% higher in 2009, 7.7% higher in 2008).[42]

ecopetrol, ecopetrol oil production, oil production in colombia, government owned companies, oil pipelines, oil in latin america, ecopetrol revenue, gulf of mexico, exploratory blocks, oil refining, distillates, oil output, oil demand, oil production, oil reserves, % rise, ecopetrol results, colombia oil exports, agreements, partnerships, pipeline company, natural gas,