Industrial and Commercial Bank of China (SEHK:1398, SSE:601398, NASDAQ:IDCBY) is a commercial and retail banking financial services institution specializing in personal, corporate and investment banking. Though it serves primarily the Chinese market (most of its 260 million customers)

it has a significant and growing business abroad (its Belgium (Belgium Bank offers numerous banking services ranging from per sonal to investment finance) and Hong Kong (offers personal Renminbi banking services) subsidiaries each have over 20 branches). In addition the bank operates in Canada (70% interest in the Bank of East Asia Canada), recently made a takeover offer for Thailand Bank ACL and opened a branch in Hanoi, Vietnam. In all international business spans 20 countries where customers are served at 200 branches (includes Hong Kong in summer 2011, up from 162 branches in early 2010).[1]

sonal to investment finance) and Hong Kong (offers personal Renminbi banking services) subsidiaries each have over 20 branches). In addition the bank operates in Canada (70% interest in the Bank of East Asia Canada), recently made a takeover offer for Thailand Bank ACL and opened a branch in Hanoi, Vietnam. In all international business spans 20 countries where customers are served at 200 branches (includes Hong Kong in summer 2011, up from 162 branches in early 2010).[1]

sonal to investment finance) and Hong Kong (offers personal Renminbi banking services) subsidiaries each have over 20 branches). In addition the bank operates in Canada (70% interest in the Bank of East Asia Canada), recently made a takeover offer for Thailand Bank ACL and opened a branch in Hanoi, Vietnam. In all international business spans 20 countries where customers are served at 200 branches (includes Hong Kong in summer 2011, up from 162 branches in early 2010).[1]

sonal to investment finance) and Hong Kong (offers personal Renminbi banking services) subsidiaries each have over 20 branches). In addition the bank operates in Canada (70% interest in the Bank of East Asia Canada), recently made a takeover offer for Thailand Bank ACL and opened a branch in Hanoi, Vietnam. In all international business spans 20 countries where customers are served at 200 branches (includes Hong Kong in summer 2011, up from 162 branches in early 2010).[1]It had the highest market capitalization in the world for a financial institution, US$173,918 in December 2008 which was about 7.9 times higher than its 2006 IPO[5]

It markets credit products and services in China to unique groups of people through different brand names (ICBC Xplore Visa targets youth, Dual Currency Visa Card targets people based on how often they travel between Hong Kong and China).

According to Bloomberg ICBC and 2 of China's other largest banks trade at an average of 1.9 times estimated end of 2010 book value and about 10 times expected full year earnings.[2]

Overseas business is small ; 3.0% of operating income (RMB11.37 billion up from RMB8.722 billion in 2009) up from 2.8% (RMB8.722 billion) in 2009. Overseas loans make up 5.0% of all loans (339.836 billion RMB) up from 4.1% (234.198 billion RMB). Overseas business : approx 4.1% of pre tax profit, 3.3% of assets.[3]

Contents

1 Company Overview

2 Business & Financials

2.1 2010 fiscal year ended December 31, 2010

2.2 2010 at the half

2.3 2009

2.4 2008

3 Financial Data

4 Trends & Forces

4.1 Curbed Lending Affects Home Prices in China

4.2 China Central Bank Injection of Money into the Market

5 Largest shareholders in the ICBC (2011)

6 References

72.9% of domestic loans are corporate loans, 1.8% are discounted bills (decreased 64.5%), the rest personal loans (personal loans up to 25.4% of loans compared to 22.0% in 2009; overall they grew 35.3% to 1.634 trillion RMB). Transportation and manufacturing represent 41.1% (21.1 and 20) of all corporate loans (1.8 out of 4.7 trillion RMB); mining is only 2.8% (129.488 billion RMB).[3] In 2003 4% of its customers were corporate (just over 8 million) and its assets represented 20% of all assets within the Chinese banking industry.

The bank continues to support social and economic development in China (according to Chinese financial policies) including infrastructure areas supporting emerging industries while limiting lending to large polluters and large energy consumers.

Company Overview

In 2010 financial investments (to 3.7 trillion RMB from 3.58 trillion RMB in 2009) made up 27.6% of total assets. Derivative financial assets decreased 35.86% to 262.227 billion RMB and represent only 1.95% of total assets.[3]

Personal banking - savings accounts, time and offshore deposits, internet, loans (personal, mortgages (under Mortgage Plus in China), car/taxi/bus/equipment leasing and financing).

Corporate banking - wealth management services (including FX market trading), commercial, community, securities lending, cash management, finances mergers, acquisitions and infrastructure projects

Investment banking - operates in treasury and securities (brokering services), bond investment, finance and asset management, strategic advisory, investment and risk management services.

Trends & Forces

Curbed Lending Affects Home Prices in China

Government financial policies have as recently as 2009 been based on the view that a housing price correction is needed. Working with banks like ICBC the government of China has been active in promoting low cost public housing after property prices rose 10.3 % in the year leading up to July 2010. Those policies affect mortgage and infrastructure lenders like ICBC by reducing the size of loans, raising interest rates and forcing some property developers out of the market by affecting their gross margin.[11]

China Central Bank Injection of Money into the Market

In the summer of 2010 the Central Bank of China injected large amounts of money into the market, $24.3 billion US in June then another $10.3 billion US in September.[12][13] Stimulus helps ICBC because it enables people to spend more and a lot of the purchases require financing.

Largest shareholders in the ICBC (2011)

You could say the bank is state run with the government of China having direct/indirect ownership of over 70% of it. Over half of the other 30% of shares are owned by a subsidiary of HKEx the Hong Kong Stock Exchange one of the 2 main exchanges ICBC shares are traded on.

Central Huijin Investment Ltd"" - the largest shareholder by a small margin (0.1% more than the MOF of China) which is 100% owned by the government of China. It is the subsidiary of China Investment Corporation a financial institution whose business is strictly in making equity investments in state owned financial institutions.

Shareholders in order of stake as of early 2011: Central Huijin Investment Ltd (35.4%), The Ministry of Finance of the People’s Republic of China (35.3%), HKSCC Nominees Limited (24.5% up from 16.3% in 2009), ICBC Credit Suisse (0.3%),Ping An Insurance (Group) Company of China, Ltd. (0.3%) ), Goldman Sachs American Express Company (0.2%), China Life Insurance Company Limited (0.1% down from 0.2% the previous year), China Huarong Asset Management Corporation (0.1%), E-Fund 50 Index Securities Investment Fund (0.1%).[3]

National Council for Social Security Fund held 4.2% of stock in 2009 but didn't have any at the end of 2010 and Fortune SGAM Selected Sectors Fund had 0.1% in 2009 but none in 2010 were down.

Business & Financials

2010 fiscal year ended December 31, 2010

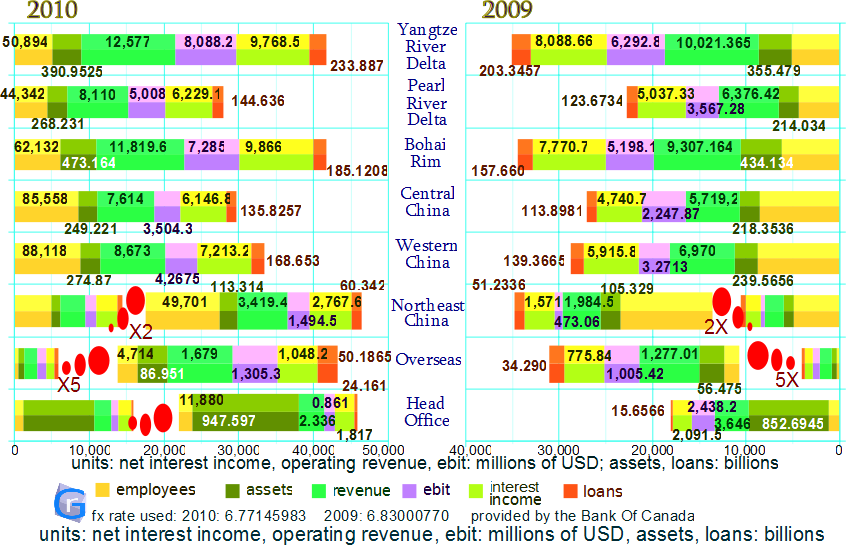

All main financial indicators showed year on year growth;. Customer deposits (from domestic operations in China) remain the main source of capital funds (97.9% from China 2.1% from abroad). Corporate deposits are at 49.1% (49.05 in 2009) with 65% of corporate deposits being demand deposits (2.25 trillion RMB or about US$350 billion up 444.5 billion RMB compared to 2009). Personal deposits 47.0% (47.7% in 2009) with 57% of that time deposits the rest demand deposits.[3] Investment in securities grew by 623.661 billion RMB (23%) in 2010 (to 3.322915 trillion RMB) with the strongest growth coming from policy bank funds (represents 29.4% of securities up from 28.1%) and government bonds (up to 728.4 billion RMB from 570.952 billion RMB). Loans secured by mortgages grew 26.8% (up to 2.78 trillion RMB); there was an overall slight drop in overdue loans (down to 64.348 billion RMB or 0.9% of all loans from 77.088 billion RMB or 1.4% of all loans in 2009) though the majority of those overdue loans (89% up from 78.6% in 2009) remain overdue by more than 12 months. The positive showing in overdue loans helped to stabilize the bank's moody's credit rating (A1). Personal consumption loans (total 267.65 billion RMB) and credit card overdrafts (91.56 billion RMB) jumped the most (69.7% and 148.3% respectively, yoy). Graph to the right shows the bank's regional data (operating income (revenue), net interest income, earnings before tax (EBIT) and assets by region in China and overseas).'

The bank continued to support social and economic development in China (according to Chinese financial policies) including infrastructure areas supporting emerging industries while limiting lending to large polluters and large energy consumers.

The bank was making more loans with small business loans growing 15% more than the bank's average growth rate of total loans and personal loans 9.9% more than the bank's overall average. 54.6% of business transactions were made through e-banking. The reformation of RMB fund management system which efficiently manages and prices fund management product transactions was completed giving the bank a competitive over domestic banks. 441 of the bank's 2,807 innovative products were introduced. Risk management was improved with the addition of concentration risk, reputation risk and strategy risk management into the framework, and enhanced the application of internal rating achievements at a group framework level.

2009

Net profit rose 16.3% (18.17 billion RMB) due in part to increased net fee and commission income (25.3% higher which is important since it contributed 17.82% (3.63% higher) of operating income (which was steady)) which counteracted negative pressure from lower interest spread. Due to economic uncertainty it was more careful in investment decisions, focusing more on stable operations and pulling away from risky business (interest in non performing loans fell by 16 billion RMB, the ratio fell by about a third to 1.54% of loans, got rid of many foreign currency high risk bonds). A large increase in investment banking income allowed ICBC's investment segment to reach 10 billion RMB in revenue which is significant since no other Chinese bank reached that level. Net Interest Income was the main problem on an otherwise stable financial statement. It decreased 6.5% (interest expeses fell 9.8%) in 2009 mostly because of lower market and benchmarket interest rates which affected yields from interest generating assets (about a quarter lower than 2008) (though since the 4th quarter of 2009 interest spread and interest margin improved).

In China the bank experienced consistent monthly and quarterly growth in loans (24.2% higher on the year reaching 1 trillion RMB) allegedly due to its role restructuring China's economy (by promoting/discouraging (high pollutors, high energy consumers) sectors through its influence on capital finance and the state's regional development policies). Online services offered were enhanced by its new IT application system (NOVA+).[4]

2008

After tax profit rose 35.2% due largely to growth in net fee and commission income (accounted for 14.19% of operating income, up 8.05%) and a reduction in the cost:income ratio (29.84% which was 5.18% lower than 2007). ROE was also higher (19.43% for weighted average (3.2 higher), 1.21% for average (0.19 higher)). Earning per share (RMB 0.33) were 83.3% higher than they were when the bank went public in 2006.

The bank continued to be a major player in China in several key financial sectors; ranked #1 in assets under custody, #1 Annuity Service Institution (50% market share).

In 2008 It issued 238 million bank cards (39 million credit cards) and its e-banking growth helped increase the proportion of its business done off counter (43.1%). The balance of non performing loans fell, some of it due to its internal ratings based approach in assessing credit risk.

Financial Data

Key Financial Metrics (RMB$ million) 2005 2006 2007 2008 2009 1HFY09 1HFY10 Change (%) 2010[3]

Revenue 171,620 181,638 257,428 310,195 309,411 148,082 180,928 28.93% 380,748

Operating Expenses 81,585 77,397 104,660 111,335 120,819 53,048 61,869 14.74% 139,480

Net Interest Income 153,603 163,542 224,465 263,037 245,821 116,038 143,312 23.5% 303,749

Operating Profit 63,021 72,052 115,362 143,398 165,307 84,822 109,366 28.93% 213,280

Gross Loans 3,631,171 3,289,553 4,073,229 4,571,994 5,728,626 5,436,469 6,354,384 16.88% 6,790,506

Net Income 39,019 49,880 82,254 111,226 129,396 66,724 84,965 42.4% 166,025

Customer Deposits 5,736,866 6,326,390 6,898,413 8,223,446 9,771,277 9,533,117 10,832,789 13.63% 10,385,487

Total Equity 6,456,131 7,508,751 8,683,712 9,757,146 11,785,053 11,434,607 12,960,381 13.34%

Earnings a share 0.15 0.18 0.24 0.33 0.38 na na na 0.48

Data for 2005[6] 2006, 2007[7] 2008, 2009[8] 1HFY09[9] 1HFY10[10]

Error creating thumbnail

2009 Moody's gave gave the bank an A1/Positive rating, slightly higher than in any other year in the last 7 years.

A rating means the bank is perceived as being subject to low credit risk and having elements that suggest susceptibility to impairment over the long term.

References

↑ China's ICBC buys 80% stake in Argentina bank (August 5, 2011).

↑ ICBC, BOC Profits May Signal Strength in China's Bank Industry (2010-08-24).

↑ 3.0 3.1 3.2 3.3 3.4 3.5 Industrial and Commercial Bank of China 2010 Year End Results (2011-04-02).

↑ Industrial and Commercial Bank of China 2009 Annual Results

↑ Agricultural Bank of China sets new IPO record (2010-08-15).

↑ ICBC 2007 Annual Results

↑ 2008 Annual Results

↑ 2009 Annual Results

↑ ICBC 2009 Interim Report

↑ Industrial and Commercial Bank of China 2010 Interim Results

↑ Home Prices in China to Decline Starting From September, BNP Paribas Says (2010-09-02).

↑ China's central bank injects 166 bln yuan into market this week (2010-06-10).

↑ China's central bank injects 70 bln yuan into money market this week (2010-09-02).

icbc china bank investors government customers clients workforce employees industrial bank china commercial banks major banks competition JPMorgan revenue, banking deposits, liquidation home prices real estate bubble market