Few inputs impact the world economy like the price of oil. Oil powers cars, tru cks, boats, airplanes, and even power plants that make up the backbone of the global economy. As oil prices rise, costs go up for transportation companies, squeezing their profit margins and forcing them to raise prices, similarly affecting all the other companies that rely on them to transport products and people. By contrast, most energy companies benefit from higher oil prices, either from higher revenues for oil, or because of increased demand for substitute energy sources such as ethanol and natural gas. The extreme volatility of this important economic input has piqued interest in issues like peak oil, speculation, and the world's rising energy appetite, and is leading to greater investment in renewable energy.

cks, boats, airplanes, and even power plants that make up the backbone of the global economy. As oil prices rise, costs go up for transportation companies, squeezing their profit margins and forcing them to raise prices, similarly affecting all the other companies that rely on them to transport products and people. By contrast, most energy companies benefit from higher oil prices, either from higher revenues for oil, or because of increased demand for substitute energy sources such as ethanol and natural gas. The extreme volatility of this important economic input has piqued interest in issues like peak oil, speculation, and the world's rising energy appetite, and is leading to greater investment in renewable energy.

cks, boats, airplanes, and even power plants that make up the backbone of the global economy. As oil prices rise, costs go up for transportation companies, squeezing their profit margins and forcing them to raise prices, similarly affecting all the other companies that rely on them to transport products and people. By contrast, most energy companies benefit from higher oil prices, either from higher revenues for oil, or because of increased demand for substitute energy sources such as ethanol and natural gas. The extreme volatility of this important economic input has piqued interest in issues like peak oil, speculation, and the world's rising energy appetite, and is leading to greater investment in renewable energy.

cks, boats, airplanes, and even power plants that make up the backbone of the global economy. As oil prices rise, costs go up for transportation companies, squeezing their profit margins and forcing them to raise prices, similarly affecting all the other companies that rely on them to transport products and people. By contrast, most energy companies benefit from higher oil prices, either from higher revenues for oil, or because of increased demand for substitute energy sources such as ethanol and natural gas. The extreme volatility of this important economic input has piqued interest in issues like peak oil, speculation, and the world's rising energy appetite, and is leading to greater investment in renewable energy. Who Ben efits from Rising Oil Prices and Loses from

efits from Rising Oil Prices and Loses from

efits from Rising Oil Prices and Loses from

efits from Rising Oil Prices and Loses fromFalling Oil Prices The Most ? enlarge

Alternative energies like wind, solar, and geothermal, as well as alternative fuels like biofuels, ethanol, cellulosic ethanol, and fuel cells all see increases in demand when the price of oil, their main competitor, increases.

Contents

1 Crude Oil Classifications

4 Why Oil Prices Rise or Fall

4.1 IEA outlook stresses increased output

4.2 Supply Shocks

4.2.1 Violence Against Producers

4.2.2 Transportation Bottlenecks

4.3 Peak Oil and Declining Production

4.4 U.S. Dollar Value Fluctuations Cause Positive Feedback on the Price of Oil

5 Speculation

5.1 Contango Causes Some Oil Price Volatility

6 Investment Strategies: Ways To Invest in Oil

6.1 1) Buy some dirt and drill a well

6.2 2) Private Placement

6.3 4) Oil-Related ETFs

the Green New Deal

More restrictions on fossil fuel emissions mean higher cost of production, and higher cost of production means the closure of uncompetitive manufacturing businesses, and those closures mean fewer manufacturing jobs. These losses and their knock-on effects beyond the manufacturing sector would amount to 1.1 million jobs lost by 2025 and 6.5 million by 2040, according to NERA.

The loss of jobs results in a corresponding decline in gross domestic product, with a loss of $250 billion by 2025 that accelerates to $3 trillion by 2040.

Coal companies such as Peabody Energy, Arch Coal, CONSOL Energy, and Massey Energy Company see sales growth, as rising oil prices cause consumers to demand more local sources of energy; the U.S. is the world's second largest coal producer, after China, and there are estimates stating that U.S. coal deposits have more energy than the world's remaining oil reserves.[1]

Hybrid car manufacturers like Toyota, Honda, GM, Ford, and Nissan benefit from higher oil prices because high oil prices lead to higher gas prices, causing consumers to seek out ways to reduce the amount of gasoline they use. Automakers that have announced plans to produce electric cars also can benefit, and will if oil prices start to rise again over the next few years; these companies include Daimler, Renault, Toyota, General  Motors, Ford and Mitsubishi.

Motors, Ford and Mitsubishi.

Motors, Ford and Mitsubishi.

Motors, Ford and Mitsubishi.Independent Oil & Gas companies benefit the most from high oil prices, as they can extract crude at a relatively constant cost from a reserve, but sell it at higher and higher prices. The higher the price of oil, the larger an E&P company's margins.

Oilfield services sea day rates (and, thus, margins) skyrocket, as upstream oil companies scramble to increase production, causing demand for drilling rigs and other oilfield services go through the roof. Machine tools & accessories companies also benefit, as they sell individual parts to oilfield services companies that build, retrofit, and repair rigs.

Deepwater drilling contractors like Transocean and Diamond Offshore Drilling are even better off than their peers in the oilfield services industry; there are far fewer deepwater rigs in the world th

The oil majors are the very largest of the non-national oil companies, and are vertically integrated. These companies explore for and produce crude oil and natural gas; they transport it by pipeline and tanker; they refine crude oil into finished petroleum products; and they also market crude oil, natural gas, and refined petroleum products to industrial users and retail consumers. The majors get most of their money from selling refined petroleum goods; vertical integration allows them to sell high-priced crude to themselves at production costs, causing the margins on these goods to go through the roof. Often, however, they must buy crude to supplement their own production, as their refining capacities are greater than their upstream production capacities. This offsets some of their profitability.an normal rigs, and with conventional wells drying up, oil companies have been willing to pay more to get at the difficult-to-reach reserves. Before the oil price collapse in the middle of 2008, floating offshore rigs could go as high as $292,000[2], while deepwater oil exploration rigs were contracting at above $800,000 per day.[3]

With the price of oil having been above $100 per barrel, the world's waste management companies (like Waste Management (WMI)) are considering "landfill mining", as high-quality polyethylene prices have doubled since the summer of 2007[4], making the world's trash landfill operators' treasure.

Some chemical companies, like Sociedad Quimica y Minera S.A. (SQM), Terra Industries (TRA), Agrium (AGU), and Potash Corporation of Saskatchewan (POT); these companies produce chemicals like fertilizer, the demands for which increase when oil prices rise due to increased demand for biofuels that need such agricultural chemicals.[5]

The genius store called, they're running out of you.

Crude Oil Classifications

Oil is generally classified based on it's density and sulfur content. The density of oil is normally report

ed according to it's API Gravity in conformance with standards set by the American Petroleum Institute (API). API Gravity is a type of dimensionless number and therefore, does not have any specific units, although gradations on the API density scale are commonly referred to as "degrees" in oilfield vernacular. Since the scientific difference between density and it's more commonly understood "cousin," weight, is not widely understood, oil density is often mistakenly referred to as weight, and instead of discussing "low density" and "high density" oil, the accepted practice is to talk about "light" or "heavy" oil.

Light crude has low density making it easier to transport and refine. Light crude is chemically "closer" to many desired finished products such as gasoline and diesel fuel and as such usually requires less refining and processing and therefore is typically more valuable and more expensive than "heavy" oil.

Heavy crude has high density, making it more difficult to transport and refine. Heavy crude is cheaper to buy and usually cheaper to extract[6], though heavy crude produced from tar sands can cost twice as much as conventional drilling.[7]

Heavy crude oil is typically defined as having a specific gravity greater than .933; however the distinction is often more functional than empirical, with any crude being labeled "heavy" that does not flow as well as its light counterpart.[8]

Sweet crude oil is oil with a low sulfur content (typically < 0.5%) which results in lower refinery costs and fewer impurities.

Sour crude has a sulfur content above 0.5% by weight, making it more expensive to refine, and therefore worth less per barrel.

While sweet crude is generally the crude oil refined into gasoline, some refining companies, notably Valero Energy (VLO), have developed refining processes that allow them to refine more challenging, but cheaper, higher-sulfur petroleum.[9]

Crude oil is priced in terms of regional blends, each with different characteristics. Of these, certain blends are followed by traders, as they most reflect the overall value of oil, and therefore affect the way different blends are priced. These are essentially like a Consumer Price Index for different types of oil. There are about 161 different types of crude that are traded around the world; the four primary benchmarks, of which these are priced internationally, are Brent Crude, West Texas Intermediate, Dubai, and the OPEC Basket.[10]

Brent Blend: Based on the prices of Brent crude, which is a light, sweet crude, from 15 different oil fields in the North Sea.[11]

West Texas Intermediate (WTI): The benchmark for oil prices in the US based on light, low sulfur WTI crude[12]. WTI remains the benchmark for oil prices in the US despite the fact that its production has been falling for years.[13]

Dubai: Dubai crude, from Dubai, is a benchmark for Persian Gulf crudes, and is light yet sour.[14]

OPEC Basket: The OPEC crude basket is OPEC's benchmark, and is made up of 13 different regional oils: Algeria's Saharan Blend, Angola's Girassol Ecuador's Oriente, Indonesia's Minas, Iran's Iran Heavy, Iraq's Basra Light, Kuwait's Kuwait oil Export, Libya's Es Sider, Nigeria's Bonny Light, Qatar's Qatar Marine, Saudi Arabia's Arab Light, the United Arab Emirates' Murban, and Venezuela's BCF 17.[15]

Spot Prices versus Futures Prices

Spot prices are the prices paid for oil here and now - as in, the amount of money you would hand a producer in exchange for their tossing a barrel of oil into the back of your truck. Futures prices, on the other hand, are the prices paid for contracts promising the delivery of oil at a future date. Whether or not the prices of oil futures affect spot prices is one of energy economics' most prevalent modern debates.

Moreover, there really is no "true" spot market for oil, in the sense of that there is a "true" spot market for stock or other financial assets.[citation needed] A "true" spot market requires, as described above, the actual physical transfer of the goods, to the purchaser, directly at the time of purchase, and there simply are no large scale sellers of crude oil, that operate in such a fashion. The "spot" prices that are quoted, involve the transfer of 1000 barrels of crude oil, not one or two.[citation needed] That would require literally 5 of 6 tractor-trailer rigs to carry off back to your house: the transportation costs would approach the value of the oil itself.[citation needed] When one speaks of a "spot" price for crude oil, one is meaning the current trading price, of the next future contract that will come due.

Those that claim that futures prices (and, therefore, speculation) do not affect spot prices argue that people who purchase futures contracts do not actually purchase any real oil. When a fund purchases a futures contract and that contract comes due, it must sell the oil to someone who will actually use it, because that fund has no way of actually keeping the physical product. This means the oil must come to market - no matter what the price. If a firm buys a $150/barrel futures contract in June for July and the spot price in July is $140, the firm must buy the oil at $150, and then it MUST sell the oil at $140 as well, because it can't actually hold the oil. This means there is no accumulation of oil - firms can't hoard oil, so they can't actually affect the present market. Therefore, it is argued, the prices of futures contracts have no affect on spot prices.

Those that believe futures speculation has an effect on spot prices (at least, those with a sound understanding of economics) argue that when oil futures are traded, oil purchasers, like refiners, try to buy oil at prices that will benefit their margins in both the short and long term. If it is believed that oil prices will rise in the future (indicated by futures prices being higher than present prices), purchasers will want to stock up on oil at lower prices today and put it in inventory; this drives up demand for crude in the present, forcing oil prices up in the present. Thus, it is argued, high prices for oil futures leads to high prices for oil in the present.

Shifting Oil Dynamics-Relying more on Canada -> click here for tables US oil imports 2020, 2019, 2018

Non-OPEC Crude Oil and Liquid Fuels Production Growth

Non-OPEC Crude Oil and Liquid Fuels Production Growth[16]

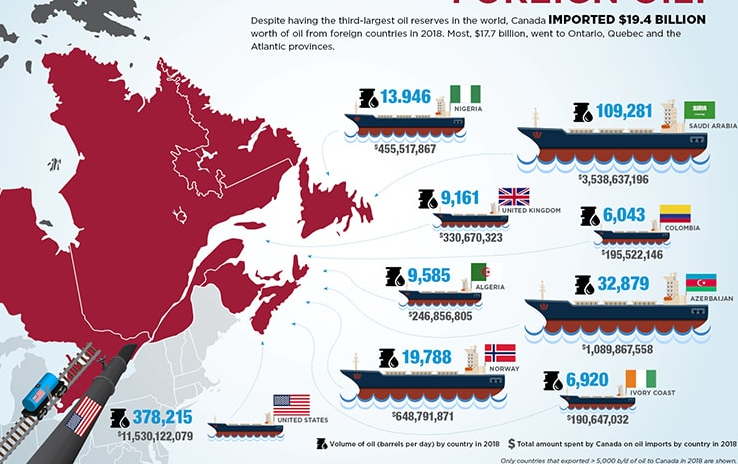

Where oil is coming from is changing. In 2010, according to the US Energy Information Administration, the top five oil suppliers to the United States were (from highest to lowest) Canada, Mexico, Venezuela, Saudi Arabia and Nigeria, this represented 59% of all imports.Canada is rising and Mexico and Venezuala are falling.[16]

In Canada the Athabasca oil sands reportedly hold 1.7 trillion barrels of oil. Currently 1.25 million barrels are extracted daily from the Canadian oil sands and one million goes directly to the US. 16% of US oil imports come from Alberta and it will only continue to grow. The oil majors BP (BP), Royal Dutch Shell (RDS'A), and Exxon Mobil (XOM) have commited $125 billion to production in Alberta over the next 20 years. Total US imports from Alberta are expected to reach 5 million bbd, according to the National Resource Defense Council, by 2020.[16]

This means big opportunities for Canadian oil companies and others with a strong presence in oil sands. With the US trying to ween itself off of OPEC countries, its own supplies slowing and its neighbor to the sounth drying up, watch out for Canada to reap the benefits. Companies like TransCanada are already investing heavily with a $7 billion pipeline expansion that would run 1,800 miles of pipe into the US and double its exports to the US to 1.1 million barrels per day.[16]

Why Oil Prices Rise or Fall

IEA outlook stresses increased output

According to the IEA, global output of crude needs to increase significantly in 2011 in order to meet faster-than-expected oil demand growth.[17] In its January report, the IEA increased estimated demand for 2010 and 2011 by 320,00 barrels/day.[18] As of January 2011, the IEA predicts a rise in demand of 1.4 million barrels a day in 2011 compared to estimated 2010 levels.[19]

The direct consequence of tighter oil supplies is higher crude prices; a consequence the IEA believes will stymie the global economy.[20] According to the IEA, if oil prices reach and remain at $100/barrel in 2011, global expenditures have the potential of rising to 5% of GDP, a level associated with economic problems in the past. The IEA plans to pressure OPEC to lift its production ceiling as a result of these findings, but OPEC has disagreed with the IEA's predictions.[21] While the IEA believes that global inventories are not sufficient to meet demand without an increase in production levels, OPEC believes the IEA's estimates of inventories are incorrect and does not expect as drastic an increase in demand relative to supply as the IEA does. Nevertheless, global production levels have the potential of being crucial to the price stability of crude oil in 2011.[22]

Supply Shocks

At last some rationality in our lttlie debate.

Violence Against Producers

Violence in unstable regions can cause oil prices to be volatile because of geopolitical events affecting the ability of upstream oil companies to produce. Terrorist and political attacks can damage drilling rigs or the transportation and refining networks -- including pipelines, shipping facilities, and refineries -- that bring oil from where it is extracted to the consumer. During the spring of 2008, for example, Nigerian rebels initiated attacks on the oil majors' pipelines and deepwater drilling rigs in the country. Despite the fact that OPEC's lead producer, Saudi Arabia, announced it would increase production by 2%, a rebel attack on one of Shell's deepwater rigs sent prices to $136.[23]

Transportation Bottlenecks

When there are problems with the pipelines that transport oil, it can't get to market; this effectively reduces the supply of crude oil to the world's refiners, causing the supply of refined products to fall. When supplies fall, prices rise. On March 28th, 2008, the day after the bombing of one of Iraq's primary export charges, Brent crude rose on the London exchange by $1.01.[24]

Peak Oil and Declining Production

Peak oil refers to the "peak" on the graph of global oil production. Oil must first be discovered, then produced, and will eventually be depleted. Peak Oil is not a theory. It is a fact. Oil has already peaked in the USA and more than 50 other oil producing countries. Oil has a finite supply, so, just the same as the production of any geological commodity, oil production will graphically (mathematically) "peak" and then irreversibly decline.

Once the halfway point, or "peak", has been passed, production begins an irreversible decline (the production profile of the remaining oil is similar to the inverse of the first half of the production curve). Peak Oil is sometimes misunderstood to mean that "we are running out." of oil. However, the peak only means half of the oil has been extracted, while the other half still remains to be extracted. Many have speculated that as supplies decline, prices for oil will rise unless there are successful conservation efforts and/or new technologies developed that would mitigate the decline in oil supplies projected by peak oil theory.

The timing of the peak in global oil production is highly controversial because of the political and economic impacts expected from Peak Oil including the impact on the stocks of all companies in the global marketplace dependent upon oil for it's main source of energy. Many analysts believe Peak Oil is imminent, even though estimates of the exact year of the peak vary widely from 2010 to 2050 or beyond. However, some analysts, such as Matthew Simmons, have concluded that global oil production has already peaked [25].

Currently being analyzed and discussed is the issue of whether Peak Oil is being "masked" by the drop in demand due to the global economic crisis and that maybe the Peak is being shaped into more of a plateau. This would be similar to the Peak in US oil production that was predicted as early as 1956 and subsequently actually occurred in 1971, but was not confirmed until about 1974. The fact that the actual Peak cannot be accurately predicted, but will only be confirmed years later suggests that aggressive action should be taken to alleviate the economic and political impacts of Peak Oil well before the Peak. Unfortunately, it may already be too late to plan intelligently for Peak Oil impacts and the world now faces extreme distress, in securities markets and otherwise.

Theories that opening the Arctic National Wildlife Refuge and offshore drilling sites in the U.S. to development would alleviate gasoline prices are likely misguided; Jim Sweeney, director of the Precourt Institute for Energy Efficiency at Stanford University, says that offshore U.S. reserves would account for just 1% of worldwide consumption, but wouldn't be productive for 10-15 years.[26]

U.S. Dollar Value Fluctuations Cause Positive Feedback on the Price of Oil

The United States imports much of its oil, and that oil is purchased abroad in U.S. dollars. The price of oil, in fact, is pegged to the dollar. The changing value of the dollar in comparison to other currencies impacts the price paid by end users. A strong dollar means a lower price, in dollars, for oil, and a weak dollar means more dollars must be spent to purchase the same amount of oil. Currency fluctuations are complex (for a more complete discussion see currency fluctuations) but the value of a currency is impacted by the relative value of goods imported and exported by an economy (known as the trade balance), its interest rates, the size of its national debt, and its economic growth.

Speculation

Some analysts believe that oil prices are at record highs because of speculation about the future value of oil. Specifically, these analysts claim that the belief that oil supply is lower than it is and the belief that future oil supply will be just as low has led traders to inflate the prices of oil futures. When oil futures are traded, oil purchasers, like refiners, try to buy oil at prices that will benefit their margins in both the short and long term. If it is believed that oil prices will rise in the future (indicated by futures prices being higher than present prices), purchasers will want to stock up on oil at lower prices today and put it in inventory; this drives up demand for crude in the present, forcing oil prices up in the present. Thus, high prices for oil futures leads to high prices for oil in the present.

OPEC believes that record fuel prices are not a function of supply and demand, but a function of Western government policy and rampant speculation, and has used this belief as an excuse not to raise production by the amounts demanded by the West.[27] While much of the data shows that production has been slowing, it's likely that speculation could account for some of the present price spikes.

When oil prices closed at record highs for five days in a row during the week of May 5th, 2008, a House of Representatives committee announced an investigation regarding the role of hedge funds and investment banks in pushing up prices. In June 2008, the U.S. commodities futures regulator announced new rules requiring daily large trader reports, and position and accountability limits for foreign crude contracts traded in the U.S.[28]

Contango Causes Some Oil Price Volatility

In early March, 2009, an April 2009 oil delivery contract traded for $38.10, while an April 2010 contract traded for $50.26, making it $12.16 more profitable for oil companies to hold onto their oil until April 2010.[29] When the future price of a commodity (e.g. oil) is higher than its present price, a situation known as "contango", it is more profitable for a commodities producer (e.g. XOM) to store the commodity and sell it at a later date. This causes oil price volatility through various channels: for example, storage of a commodity causes supply to be reduced in the present, raising spot prices, while expectations regarding future supply increase - thereby reversing the cycle, which then causes contango all over again. The wider the spread between the present price and a future price, the heavier the contango and the heavier the volatility.

Investment Strategies: Ways To Invest in Oil

1) Buy some dirt and drill a well

The "beauty" and ease of purchasing securities online to invest in lucrative commercial endeavors like oil production is best put into perspective by considering the history of the oil business and the extreme difficulty and risk of actually "investing" the time and effort to buy your own dirt and drill a well like the old timers did.

2) Private Placement

Investing in publicly traded energy industry securities, including oil and gas securities and related services companies, represents only a part of the total global investments made.

Arguably, the most lucrative way to invest in oil and gas is through a "private placement," [1].

The general public does not receive information about private placements because these are a type of securities that carry a much higher degree of risk than publicly traded securities like ExxonMobil and the like. The securities laws, both federal and state, prohibit what is known as a "general solicitation" in private placements. This means that PP's cannot be advertised, including any website open to the public, and, a telemarketing campaign cannot be utilized except to screened lists of qualified investors.

After the lessons learned from the stock market crash of the 1930's, the US government enacted various legislation that attempted to protect unsophisticated layperson "investors" from investments that carry inordinate risk. The Securities Acts of 1933 and 1934 created these protections.

Private Placements are unregistered securities that qualify for an exemption from registration.

Private Placements in oil and gas investment partnerships are only available to "accredited investors," a legal term carefully defined by the SEC.

Although there are a series of specific rules[2][3], generally, a person must have made verifiable income of at least $200,000.00 USD in the most recent two years and have a reasonable expectation to earn at least that amount in the current year. For married couples the "rule" is $300,000.00 USD between both spouses incomes (could be a $175k/ 125k split or any other percentage split).

Private Placement investments in oil and gas drilling ventures carry a very high degree of risk, so the investor must have the financial means to withstand the complete loss of the investment without sustaining undue hardship.

These strict rules cut out approximately 91.53% or so of potential US investors, thus making the world of private placements very elite by nature. Also, the SEC has proposed new, more strict rules regarding hedge funds and accredited investors. The new rule would require that investors in hedge funds be not only accredited, but also would have to meet the requirements of the Investment Company Act section 3 (c) (7) and hold at least $2.5 million USD in investments on the date of investment. This would set an extremely high bar over which to qualify and thus theoretically protect less sophisticated investors from the significantly higher risks associated with hedge funds.

Historically, private placements in oil and gas drilling and production ventures utilized a "one third for one quarter" type investment strategy. This meant that the investment partnership organizer would draft contracts that specified that 3 investors would each put in one third of the total investment. In 2008/ 2009 investment for drilling one typical well is about $2.5 to $4.0 Million dollars. The investors each put up one third of the money but get only one fourth of the "rights" to any oil or gas found and or produced. The remaining one fourth is kept by the organizer of the investment as compensation for arranging the drilling, completion of the well, production of the oil and gas and so forth.

Investors choosing to purchase securities in the form of capital stock issued by oil and gas industry companies would be wise to understand and consider the big picture and the fact that the most lucrative oil and gas ventures are often in private placements not available to the public.

Nontihg I could say would give you undue credit for this story.

4) Oil-Related ETFs

The commodities futures market can be a dangerous place to invest money. The margin requirements and intense daily volatility can provide excellent opportunities to profit, however can also cause huge losses. ETFs (exchange traded funds) allow you to trade the underlying commodity like a stock, without being hugely leveraged by margin. If more risk and leverage is part of a trader's game plan, try trading stock options on the ETFs. Oil-related ETFs in particular are great investment vehicles. Since the oil futures contracts always trade with such large volume and daily movement, it is easier to manage risk while still profiting from intra-day price action. Investors can get Live Oil ETF Prices and Charts for free to supplement their trading. Live price changes are crucial to the savy investors' and day traders' bottom line.

Stock investors can buy or short-sell oil-related ETFs. Two of the most traded ETFs are USO and OIL. Also consider DCR, UCR and DUG. In addition, there are two recently added double leveraged ETF's based on Crude Oil Futures rather than oil stocks, UCO is ultra long crude oil and SCO, ulta short crude oil. These stocks are now trading at a brisk pace and are quite liquid.

However, commodity ETFs have suffered lately due to contango, which forces ETFs to suffer losses while rolling over their futures contracts (the contracts bought by them are more expensive than the ones sold). In February 2009, for instance, crude oil rose 7.4% while USO declined by 7.4%.

oil industry, commodity oil, oil, oil refining, oil production, oil output, trends and forces, trends in oil, trending, petrleum, gasoline, vehicle sales, petrochemicals, crude oil, alberta, carbon emissions, fossil fuels, competition, renewables, environmental policy, epa, risks, impact, phasing out oil. oil petroleum gasLink Text

as industry trends,