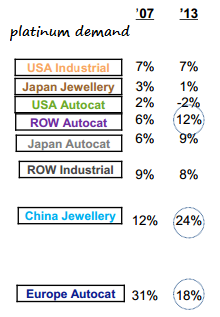

Platinum demand by sector: auto industry 46%, jewelry 31%. (automobile production up +82.8 million in 2013). 10% drop in supply in 2013 directly attributable to largest producer in South Africa experiencing disruption. 5.84m ounces mined vs global demand of 8.07m ounces. including scrap and recycled materials, demand will outweigh supply by 400 thousand ounces this year. platinum usage growing in fuel cells and pharmaceutical industry. residential fuel cells in Japan alone will increase to 5.3 million in 2020 versus only ten thousand in 2012-2013.

in 2013 directly attributable to largest producer in South Africa experiencing disruption. 5.84m ounces mined vs global demand of 8.07m ounces. including scrap and recycled materials, demand will outweigh supply by 400 thousand ounces this year. platinum usage growing in fuel cells and pharmaceutical industry. residential fuel cells in Japan alone will increase to 5.3 million in 2020 versus only ten thousand in 2012-2013.

research and analysis by SERAPHIM BLENTZAS dalhousie university

Russian company Norilsk is the world's largest producer of platinum- 2.661 million ounces down 2.6% from the previous year; followed by Anglo American Platinum (1.556m ounces steady) and Lonmin (709,000 ounces up 21.7th), both Anglo-South African companies. The largest pureplay palladium company is Toronto-based North American Palladium (135,158 ounces in 2013, down 28.822th oz). A fragile European auto market in 2013 is making China a more important customer- Chinese demand continues to grow.

Palladium is a widely used durable and versatile metal. Though useful in plating jewelry, clothes fasteners and engine systems (aircraft and automotive) most of the demand comes from industries that require catalysts (in catalytic converters it's useful due to its light weight, high boiling point, is an oxidizing agent) and versatile metals used in plating conductive materials; In electronics, palladium is preferred over nickel and platinum (plating the electrodes of capacitors is either alone or palladium in conjunction with silver); For plating electrodes, the only alternative to palladium is nickel but nickel has its limitations, it can only be used in less demanding applications. In automobile circuits, palladium holds silver plated conductive tracks in place. (platinum today: Electric Components)

The number 1 source of demand is vehicle manufacturers who make use of its capabilities as a catalyst in catalytic converters. The catalyst is required to stimulate an oxidation reaction that ultimately converts toxic combustion byproducts to carbon dioxide and water (reduction of NO to O and N is by rhodium).

Palladium accounts for 90-95 % of precious metals used in catalytic converters (95% for gasoline/20% in diesel powered vehicles) and even more noteworthy, palladium's share of diesel catalysts rose from 7% in 2007 to 20% in 2009. Each catalytic converter uses 4 grams of palladium and platinum. Palladium shares many characteristics with platinum, not surprising given that palladium is one of only six transition metallic elements comprising the Platinum Group of the periodic table (the other four being rhodium, ruthenium, osmium and iridium). Among their similarities: all are great catalysts, are hard metals making them resistant to scratches. They also have high boiling points and are noted for their electrical properties. As for platinum, its share of diesel catalysts fell to 80% compared to 86% in 2008 owing to the increased popularity of palladium. Between June 2010 and June 2011 3.1m oz of platinum was used by automakers (compare that to 5.4M ounces for palladium) however jewelry demand for platinum waned (15% less, bringing it down to 2.4M ounces; palladium jewelry demand fell 20% to 0.6M ounces), that's in contrast to late 2008/2009 when lower prices boosted demand by jewelry 70% with growth recorded in China. (Northram Platinum Ltd July 2011 Annual Report. Angloplatinum 2009 Report)

With regards to rhodium, South Africa produces 60% of the extremely reflective/corrosion resistant platinum group metal, just ahead of Russia. In 2009 the spot price of rhodium dropped like a rock, it averaged only $1,509/oz that year after averaging $5,174/oz the year before. In 2009 gold was the only metal with an iso currency code to avoid a price decline (averaged price). One of rhodiums key uses is in the production of nitric acid (nitric acid is one of the compounds usedby jewelers to verify whether or not something is real gold).

In 2010, 80% of the world's palladium came from Russia (2.7-2.9 million ounces, steady from 2008 to 2009 but down 16% from 2006) and South Africa (2.485M oz same as the previous year but down 11.3% from 2007). South Africa is home to some of the biggest platinum-palladium mines in the world namely those in the region of the Bushveld Igneous Complex (South Africa just behind Russia at 40% for palladium production but leads all countries in platinum supplying 80% of that metal (4.725M ounces). The 2011 global supply of palladium is forecast to decline 5.4% yoy to 6.8M oz from 7.1M oz in 2010 & 7.6M oz in 2009. 6.3M oz of the supply was mined. Palladium supply from the top 3 sources (Russia, South Africa, North America) is down 18% in just the last four years (2006: 6980M oz vs 2010: 5545M oz). There are a number of problems regarding supply, firstly mine depletions particularly in Russia where Norilsk has become the only major producer, also Russian stockpiles are dwindling which is significant given that traditionally it has been the largest source of non mined production (total non-mined prod: approximately 1.3 million ounces annually). Also of concern: deeper mine shafts in South Africa (mines are being made deeper because that's where the high grades are) and so there are safety concerns, the country is also struggling with foreign exchange rates and their affects on currency losses. (Stillwater Mining Company: March 2011 Presentation) Palladium primary production has fallen even faster than it has for platinum (-15% vs -12% since 2006). Stockpiles in Russia, the source of 17% of Pd supplies since 1984 are almost entirely exhausted.September 2011: HSBC, the world's #2 bank outside China, raised its 2012 price forecast for palladium by 8% to $810/oz citing the fact that demand will outstrip supply (in stark contrast to the previous two years when supply met demand). Long term price forecast raised by 21% to $850/oz. However other top banks are forecasting even higher palladium prices in 2012; JP Morgan and Credit Suisse have the spot price pegged at $938/oz and $950/oz respectively (credit suisse lowerest its 2012 forecast from $1,000 to $950 in the 1st qtr of 2011, the lowest forecasts were made by UBS ($825) and BNP Paribas ($810) *of note RBC lowered its outlook from $1000/oz to $860/oz). Between October 2008 and September 4, 2011 spot palladium increased by over 290% compared to 133% for platinum, 200% for gold and 0% for rhodium. Despite similar production (over 6M ounces), demand for palladium by end market users exceeded platinum demand by 24.0% (7.0 vs 5.72 million ounces). (Stillwater, March 2011) 91% of the world's 6.8M ounces of annual palladium supply comes from South Africa (42%), Russia (40%), and North America (9%) (includes about 1.3M ounces of secondary supply). (North American Palladium, October 2011)

In catalytic converters, palladium now accounts for over 95% of the catalysts used, up from 85% in 2007 (Stillwater Mining, March 2011) meaning that the automotive industry (a growing industry sector with 40-50 million people entering the middle class each year in China, Brazil and other rapidly developing countries) is becoming ever more reliant on palladium (6% increase in palladium use by automakers in 2011, 5.5M ounces, each catalytic converter uses 4 grams of palladium + platinum). In 2010 72 million light vehicles were produced and that number is expected to grow to 88 million by 2013 reaching 100 million by 2016. Strict pollution controls mandate the use of catalytic converters. (North American Palladium, October 2011)

More Reason To Like Palladium: Shipments to Switzerland (1 of only 2 main hubs in Europe for storage of the metal) from Russia (world's largest primary producer of palladium) are down to 500,000 ounces in 2010 (average 1.3M ounces for the last 20 years); The main reason for the decline is that Russia used to have four big producers but today they only have one, the rest have nearly exausted their reserves (the largest of them, OAO GMK Norilsk Nickel could also be deplete of palladium by 2015-2020). For 2011 output is forecast to fall by 5.4% to 6.8M ounces even though demand from carmakers alone will increase 6.7% to 5.5M ounces. Russian stockpiles form the fourth biggest source of palladium supply. The price of palladium peaked in 2001 at $1,090/oz when concerns regarding supply caused many to hoard the white metal. There are also ETF's that hoard palladium; they first began trading in 2007 and have since grown their assets to over 2M ounces (currently they trade in Europe (Zurich, London), the United States (NYC) and Japan). Total annual supply of palladium was as high as 8.58 million ounces in 2007 but has since fallen to around 7 million (6.8M in 2010/7.1m oz in 2009) a 17.2% decline even though total gross demand only fell by 7.4%; During that time Russian supplies fell 19.93% and that's directly responsible for 61.15% of the global drop in supply (1.48m ounces). (Aquarious Platinum) 2009 combined production of platinum group metals was only 16% as much as gold (Au: 2572 tonnes about the same as in 2005); Three of the top five sources of gold, the USA, South Africa, Australia combined, produced 21.1% less of the yellow metal in 2009 than in 2005.